Some Homeowners Ready to Move, but Feel ‘Stuck’

High mortgage rates and persistently high home prices have a majority of homeowners who want to move feeling stuck in their current homes, according to the Point Homeowner Sentiment and Moving Survey.

Point, Palo Alto, Calif., a home equity investment platform, surveyed 1,066 U.S. homeowners in November.

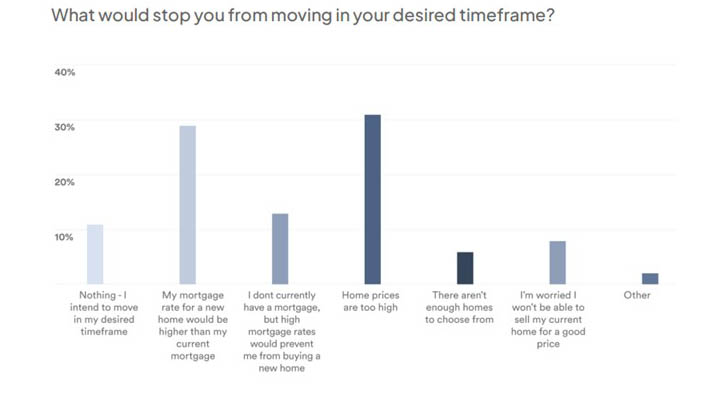

The survey found while many homeowners want to move, few believe their dream will become a reality. Only 10.9 percent of those who want to move before the end of 2023 think they will move in that time frame. Another 42.4 percent say they won’t move because of high mortgage rates, while 31 percent say they won’t because of high home prices.

According to Zillow, Seattle, buying a median-priced home in October costs $968 more per month than buying the same home a year earlier.

“It’s no secret homeowners are hunkering down as high mortgage rates and persistently high home prices stymie affordability, but it’s surprising to see just how many feel stuck — and how few choices they seem to have when it comes to tapping into the value in their current homes,” said Eddie Lim, Point co-founder and CEO. “We may see a very different home shopping season in 2023, with even more constrained inventory if current homeowners don’t feel like they can leave their current home.”

The survey said nearly one-third of all homeowners who cited high mortgage rates for keeping them in place said they would move if rates came down to the 4-4.9 percent range. However, homeowners are pessimistic about the near future of mortgage rates, with 71.9 percent saying rates will be much or somewhat higher 12 months from now.

Meanwhile, the survey found high interest rates are causing homeowners who want to renovate their current home to find other ways to pay for improvements. Of homeowners surveyed, 59 percent want to renovate their current home. Most (54.4 percent) intend to pay with cash, compared with 13.5 percent who intend to get a home equity line of credit, and 11.4 percent who will use credit cards.

Of the would-be renovators who won’t be using HELOCs or a cash-out refi, the most common reason to avoid those loans was high-interest rates (41.1 percent).

“I suspect the housing market will continue in this kind of limbo throughout the winter, but the good news is that these homeowners are sitting on record equity,” Lim said. “If people are making a choice to stay in their current homes, renovations are the next natural choice. This situation creates a unique opportunity for homeowners to leverage their existing equity to make those dreams a reality.”