June Construction Spending Down; Manufacturing Slows

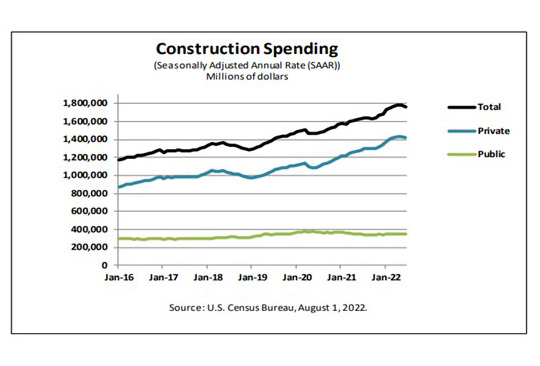

Construction spending in June fell by more than 1 percent from May, the Census Bureau reported Monday. In a separate report, Institute for Supply Management, Tempe, Ariz., said its Manufacturing Index fell by 0.2 percent to a nearly two-year low.

Census said construction spending during June fell to a seasonally adjusted annual rate of $1,762.3 billion, 1.1 percent below the revised May estimate of $1,781.9 billion, and 8.3 percent lower than a year ago $1,628.0 billion. However, during the first six months of this year, construction spending rose to $848.2 billion, 10.7 percent higher than the $766.0 billion for the same period in 2021.

The report said spending on private construction fell to a seasonally adjusted annual rate of $1,416.4 billion, 1.3 percent below the revised May estimate of $1,434.4 billion. Residential construction fell to a seasonally adjusted annual rate of $923.7 billion in June, 1.6 percent below the revised May estimate of $939.2 billion. Nonresidential construction fell to a seasonally adjusted annual rate of $492.7 billion in June, 0.5 percent below the revised May estimate of $495.3 billion.

Census estimated the seasonally adjusted annual rate of public construction spending at $345.9 billion, 0.5 percent below the revised May estimate of $347.5 billion. Educational construction fell to a seasonally adjusted annual rate of $77.5 billion, 0.7 percent below the revised May estimate of $78.1 billion. Highway construction fell to a seasonally adjusted annual rate of $97.4 billion, 2.7 percent below the revised May estimate of $100.1 billion.

“The abrupt slowdown in buyer traffic appears to have led to an outsized drop in outlays for new single-family homes in June,” said Mark Vitner, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “June’s 3.1% plunge in construction outlays for new single-family homes is the latest piece of data pointing to an abrupt slowdown in home building. Builders began to see a notable slowdown in buyer traffic in May, when mortgage rates spiked and many potential home buyers seemed to realize they could no longer afford to purchase a new home.”

Vitner said persistent labor shortages and supply chain bottlenecks have prompted builders to change their operating model. “With labor and certain essential supplies scarce, more builder inventory is now under construction and set to be quickly completed once a buyer signs a purchase contract,” he said. “Many builders are storing hard-to-source items and only using them once homes sell. This makes single-family residential construction spending much more coincident with new home sales, which coincidentally plunged 8.1% in June. That decline, however, does not include the climb in cancelations, which spiked along with mortgage rates in May and June.”

The weaker construction spending data slightly reduces the outlook for the third quarter, Vitner added. “The pullback in housing looks to be sharper and more immediate than previously thought,” he said. “Home builders’ new operating model means construction will ramp down with sales, but it will also bounce back if mortgage rates pull back and consumer confidence rebounds.”

Meanwhile, the Manufacturing ISM Report on Business said economic activity in the manufacturing sector grew in July, with the overall economy achieving a 26th consecutive month of growth, despite an 0.2 percentage point drop in the index to 52.8 percent, the lowest figure since June 2020.

“The U.S. manufacturing sector continues expanding — though slightly less so in July — as new order rates continue to contract, supplier deliveries improve and prices soften to acceptable levels,” said Timothy R. Fiore, Chair of the ISM Manufacturing Business Survey Committee. “According to Business Survey Committee respondents’ comments, companies continue to hire at strong rates, with few indications of layoffs, hiring freezes or headcount reduction through attrition. Panelists reported higher rates of quits, reversing June’s positive trend. Prices expansion eased dramatically in July, but instability in global energy markets continues. Sentiment remained optimistic regarding demand, with six positive growth comments for every cautious comment. Panelists are now expressing concern about a softening in the economy, as new order rates contracted for the second month amid developing anxiety about excess inventory in the supply chain.”

“From a 38-year high of 63.7 in March 2021, the ISM manufacturing index, a key barometer for the manufacturing sector, has been in a sharp descent signaling an ever-slowing pace of expansion in the manufacturing sector,” said Tim Quinlan, Senior Economist with Wells Fargo Economics. “In July, the headline reading of 52.8 is still consistent with expansion, but the slowest pace of expansion since June 2020 when the economy was still emerging from the COVID lockdowns.”

ISM said its Production Index reading of 53.5 percent is a 1.4-percentage point decrease compared to June’s figure of 54.9 percent. The Prices Index registered 60 percent, down 18.5 percentage points compared to the June figure of 78.5 percent; this is the index’s lowest reading since August 2020 (59.5 percent). The Backlog of Orders Index registered 51.3 percent, 1.9 percentage points below the June reading of 53.2 percent. The Employment Index contracted for a third straight month at 49.9 percent, 2.6 percentage points higher than the 47.3 percent recorded in June. The Supplier Deliveries Index reading of 55.2 percent is 2.1 percentage points lower than the June figure of 57.3 percent. The Inventories Index registered 57.3 percent, 1.3 percentage points higher than the June reading of 56 percent. The New Export Orders Index reading of 52.6 percent is up 1.9 percentage points compared to June’s figure of 50.7 percent. The Imports Index grew again in July, up 3.7 percentage points to 54.4 percent from 50.7 percent in June.