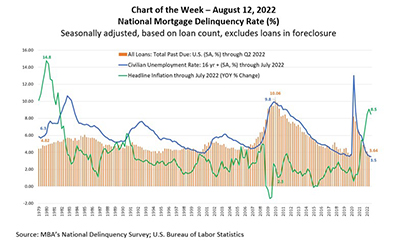

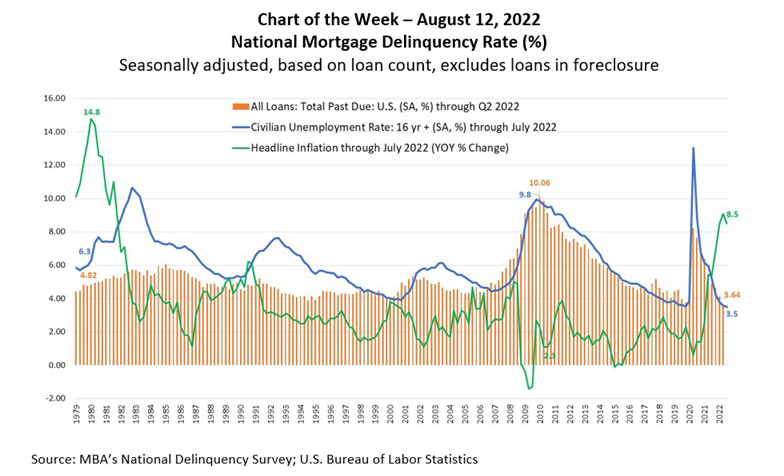

MBA Chart of the Week, Aug. 12, 2022: National Mortgage Delinquency Rate

MBA Research released second quarter results of its National Delinquency Survey. The delinquency rate for mortgage loans on one-to-four-unit residential properties was 3.64 percent – the lowest level since MBA’s survey began in 1979 and down 47 basis points from first-quarter 2022 and 183 basis points from second quarter 2021.

This week’s MBA Chart of the Week highlights the relationship between MBA’s mortgage delinquency rate and two economic indicators, the unemployment rate, and year-over-year changes in headline inflation – measuring the price of goods and services in the economy. Both of these indicators are supplied by the Bureau of Labor Statistics and could affect a borrower’s ability to make payments.

Over the span of 40 years, the mortgage delinquency rate fluctuated in relation to the unemployment rate, none more pronounced than since 2008. In the first quarter of 2010 during the aftermath of the Great Recession, the mortgage delinquency rate was at its all-time peak of 10.06 percent, while the unemployment rate reached 9.8 percent. During this year’s second quarter, the record-low delinquency rate tracks closely with an unemployment rate that was only 3.5 percent in July – a half-century low.

The relationship between the mortgage delinquency rate and year-over-year headline inflation is less apparent particularly in periods of high inflation. When inflation reached a high of 14.8 percent in first quarter 1980, the mortgage delinquency rate stood at 4.82 percent, well below the quarterly average of 5.30 percent across the period from first quarter 1979 to second quarter 2022. Today, we have the unusual situation of historically low delinquencies and unemployment, but high inflation not seen since the early 1980s – in addition to stock market volatility, increases in mortgage rates, and two quarters of economic contraction.

Yet, loan performance is as strong as ever. Of all the economic indicators that can lead to mortgage delinquencies, the U.S. unemployment rate seems to be the best gauge of loan performance.

– Anh Doan (adoan@mba.org); Marina Walsh (mwalsh@mba.org)