U.S. Homeownership Rate at 2-Year High

The U.S. homeownership rate rose to 65.8 percent in the second quarter, matching its highest rate since 2020, the Census Bureau reported this week.

Although not statistically much different from the first quarter (65.4%), the homeownership rate approached the previous post-Great Recession high 66.1 percent in 2011.

The second quarter homeownership rate was highest in the Midwest (70.1 percent), followed by the South (67.8 percent), Northeast (62.1 percent), and West (60.9 percent). The homeownership rates in the four regions were not statistically different from the second quarter 2021 rates.

Census reported 89.3 percent of housing units in the United States in the second quarter were occupied; 10.7 percent were vacant. Owner-occupied housing units made up 58.8 percent of total housing units, while renter-occupied units made up 30.6 percent of the inventory in the second quarter. Vacant year-round units comprised 8.1 percent of total housing units, while 2.5 percent were vacant for seasonal use.

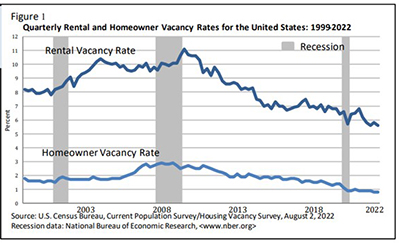

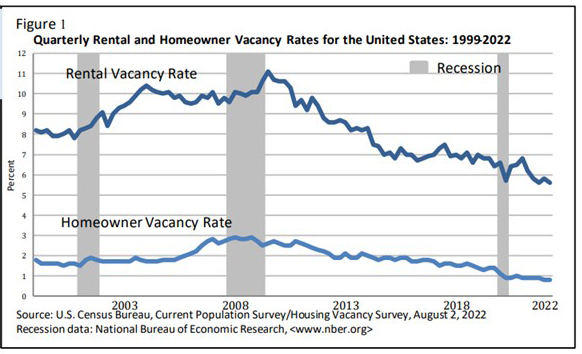

The report said national vacancy rates in the second quarter were 5.6 percent for rental housing and 0.8 percent for homeowner housing. The rental vacancy rate was 0.6 percentage points lower than the rate a year ago (6.2 percent) and not statistically different from the rate in the first quarter (5.8 percent). The homeowner vacancy rate of 0.8 percent was not statistically different from a year ago (0.9 percent) and virtually the same as the rate in the first quarter 2022 (0.8 percent).

Rental vacancy rates in the South (7.0 percent) and Midwest (6.6 percent) were higher than the rates in the Northeast (3.8 percent) and West (4.3 percent). Homeowner vacancy rates were highest in the Northeast (1.1 percent). The rate in the South (0.9 percent).

“Younger households were driving homeownership growth,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “In the second quarter of 2022, the homeownership rate for households under 35 years old increased by 1.3 percentage points on a year-over-year basis.”

Kushi said declining affordability could temper millennial homeownership demand in 2022. “Nevertheless, the lifestyle choices that highly correlate with homeownership will persist,” she said. “Buying a home is both a financial and a lifestyle decision. Despite growing affordability headwinds, millennials continue to transition into their prime home-buying age and will remain the driving force in potential homeownership demand in the years ahead.”