ATTOM: Steep Drop in Refinance Activity Drives 2nd Quarter Slump in Mortgage Lending

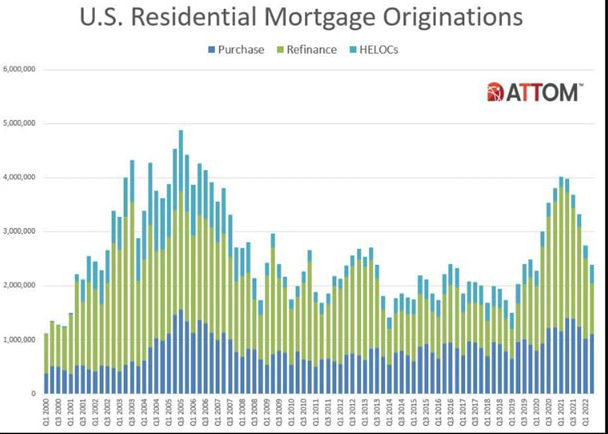

ATTOM, Irvine, Calif., reported 2.39 million mortgages secured by residential property in the second quarter, down 13 percent from the first quarter—the fifth quarterly decrease in a row—and down 40 percent from a year ago—the biggest annual drop since 2014.

The company’s second-quarter U.S. Residential Property Mortgage Origination Report showed another double-digit downturn in refinance activity more than outweighed increases in home-purchase and home-equity lending. Lenders issued $807.8 billion in mortgages in the second quarter, down quarterly by 11 percent and annually by 35 percent. The annual decrease in the dollar volume of loans marked the largest in eight years.

“Mortgage rates that have virtually doubled over the past year have decimated the refinance market and are starting to take a toll on purchase lending as well,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “The combination of much higher mortgage rates and rising home prices has made the notion of homebuying simply unaffordable for many prospective buyers, which threatens to drive loan volume down even further as we exit the spring and summer months.”

ATTOM attributed the downturn in total activity from just 941,000 residential loans getting rolled over into new mortgages during the second quarter, down 36 percent from the first quarter and down 60 percent from a year earlier. Amid another rise in mortgage interest rates, refinance lending decreased for the fifth straight quarter, hitting a point that was just one-third of what it was in early 2021. Dollar volume of refinance loans fell by 35 percent from the prior quarter and by 56 percent annually, to $310.1 billion.

ATTOM also noted for the first time since early 2019, refinance activity in the second quarter did not represent the largest chunk of mortgages, dropping to 39 percent of all loans. That was off from 53 percent in the first quarter and from a recent peak of 66 percent in early 2021.

Purchase-loan activity, meanwhile, increased modestly as the 2022 spring home-buying season kicked into gear. Despite ongoing home-price spikes, purchase loans rose 8 percent quarterly, to 1.1 million, representing 46 percent of all borrowing. Still, that gain was unusually small for the months running from April through June and left the number of purchase mortgages down 21 percent annually. The dollar volume of loans taken out to buy residential properties rose to $431.4 billion, up 15 percent from the first quarter of this year, but still down 12 percent from the second quarter of last year.

The best-performing category by far in the second quarter was again home-equity lending. Home Equity Lines of Credit shot up 35 percent quarterly and 44 percent annually, to 341,704.

“Borrowers looking to tap into their equity should know that HELOC activity has been particularly strong among credit unions and community banks, along with a small but growing number of depository banks,” Sharga said. “While non-bank mortgage lenders may begin to more aggressively originate home equity loans, it’s not likely they’ll be active participants in the HELOC market.”