CoreLogic Fraud Risk Index Down 13.5%

CoreLogic, Irvine, Calif., said its National Mortgage Application Fraud Risk Index fell in the second quarter, in part because of changes in its scoring model.

The Index fell to 121 in the second quarter, down by 13.5 percent from the first quarter (140) and down by 7.5 percent from a year ago (131).

CoreLogic attributed some of the decline in the Index to recalibration of its updated scoring model, released in the first quarter. “However, we have seen increasing risk levels during Q2 when analyzing monthly data,” it said.

The report said the second quarter showed a clear switch to purchase transactions as the majority of mortgage application activity, up from 53% in the first quarter to 71% in the second. Application volumes continued to decline in in the second quarter, but not as dramatically as they did in the two previous quarters.

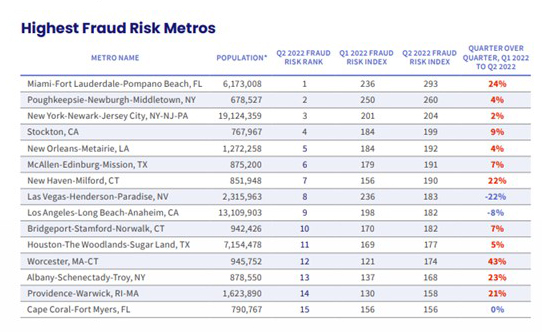

The report said Miami/Fort Lauderdale had the highest Fraud Risk index in the second quarter (293), up 24 percent from the first quarter. Two other metros—Poughkeepsie, N.Y., and the New York City metro area—had scores above 200 (260 and 204, respectively).

Rounding out the top 10 were Stockton, Calif. (199); New Orleans (192); McAllen, Texas (191); New Haven, Conn. (190); Las Vegas (183, but down by 22 percent from its first quarter reading of 236); Los Angeles (182, but down 198 in the first quarter); and Bridgeport, Conn. (182).