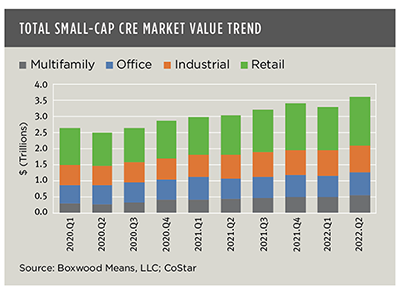

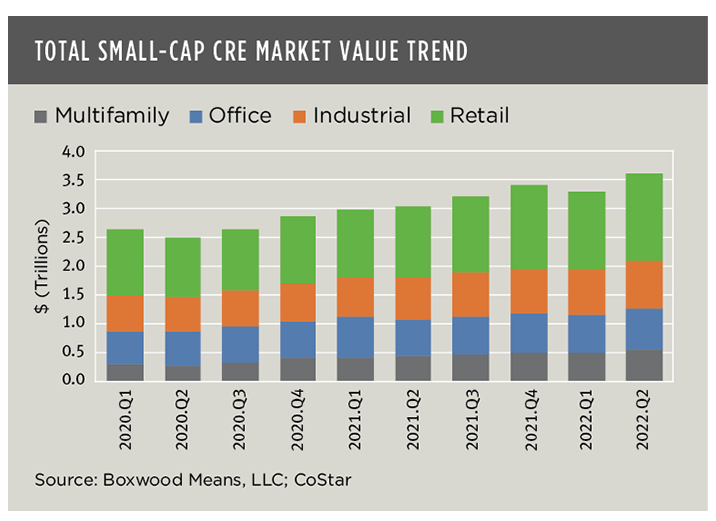

Small-Cap Commercial Real Estate Market Up 19% YoY

Boxwood Means LLC, Stamford, Conn., reported the aggregate market value of small commercial real estate assets rose steadily at midyear despite an increasingly uncertain outlook for commercial real estate prices and the economy.

“The total dollar value of the small-cap commercial real estate market has scaled to peak levels as asset prices have registered continuous gains since COVID first rattled the economy,” said Randy Fuchs, Boxwood Means Principal and Co-Founder.

Year to date, strong fundamentals have advanced in the total dollar value of small-cap commercial real estate, Boxwood Means reported. The firm estimated small cap CRE market value expanded by a sizable 9.1%, or $300 billion, in the second quarter to $3.6 trillion. The sector has grown 19.1% year-over-year.

But Fuchs noted rising interest rates and faltering investor sentiment have started to curtail growth in property prices in both small- and large-cap CRE domains.

After the brief COVID-related recession, asset prices recovered swiftly in 2020 and drove a remarkable 46% increase in the market’s aggregate dollar value since that time, Fuchs said.

Fuchs noted the compound annual growth rate provides a better way for investors to evaluate how the components of the small-cap CRE market have performed over time. There are marked differences in the rates of return over the past two years. The small-cap CRE market has grown at a healthy 14.8% annualized clip in the aggregate. Unsurprisingly, the multifamily sector was the top performer with a 30.0% CAGR, more than double the rate of return for industrial, which followed at 14.5%. These two property types were trailed by retail (12.8%) and office (10.0%). “The higher returns to multifamily and industrial largely track with investors’ recent sector preferences and favorable space market fundamentals where demand consistently outstrips supply,” Fuchs said.

While CRE assets could reprice due to additional interest rate increases and higher debt costs, the degree to which property valuations decline will depend on numerous factors, beginning with geographical market and property type, Fuchs said. “What will help small-cap investment income properties weather a potential storm is the cushion provided by historically low commercial vacancy rates,” he said. “Also, the conventional use of short-term leases that allow for quicker rent adjustments as leases expire can insulate small CRE property owners from some of the downside risk of inflation and interest rate hikes.”