MBA: 2Q Mortgage Delinquency Rate at Record Low

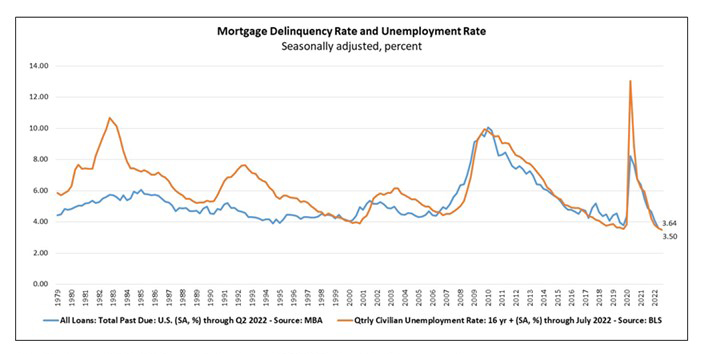

The second quarter mortgage delinquency rate fell to a record low—even beating out pre-pandemic lows—the Mortgage Bankers Association reported Thursday.

The quarterly MBA National Delinquency Survey reported the delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 3.64 percent of all loans outstanding at the end of the second quarter. The delinquency rate fell by 47 basis points from the first quarter and by 183 basis points from one year ago to its lowest level since MBA began the survey in 1979.

Marina Walsh, CMB, MBA Vice President of Analytics, noted the second quarter delinquency rate easily beat the previous record—a pre-pandemic low of 3.77 percent in fourth quarter 2019.

“Most of the improvement across all product types – FHA, VA, and conventional loans – resulted from a decline in the loans that were 90 days or more delinquent but not in the foreclosure process,” Walsh said.

Walsh also noted of economic indicators that can lead to mortgage delinquencies, the U.S. unemployment rate seems to be the best gauge of loan performance. She said despite inflationary pressures, stock market volatility, increases in mortgage rates, and two quarters of economic contraction – often defined as a recession – the job market remains incredibly strong. The unemployment rate was 3.5 percent in July – a half-century low that tracks closely with the record-low mortgage delinquency rate.

“Foreclosure inventory levels and foreclosure starts remain well below historical averages for the survey – a strong indication that servicers are able to help delinquent borrowers find alternatives to foreclosure,” Walsh said. “Such alternatives include curing, loan workouts, home sales – with possible equity to spare, or cash-for-keys and deed-in-lieu options.”

Other key findings of the MBA Second Quarter National Delinquency Survey:

–Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding to 3.64 percent, the lowest level in the history of the survey dating back to 1979. By stage, the 30-day delinquency rate increased 7 basis points to 1.66 percent, the 60-day delinquency rate decreased 7 basis points to 0.49 percent, and the 90-day delinquency bucket decreased 47 basis points to 1.49 percent.

–By loan type, the total delinquency rate for conventional loans decreased 39 basis points to 2.64 percent over the previous quarter – the lowest level in the history of the survey since 2004. The FHA delinquency rate decreased 73 basis points to 8.85 percent, and the VA delinquency rate decreased by 64 basis points to 4.22 percent over the previous quarter.

–On a year-over-year basis, total mortgage delinquencies decreased for all loans outstanding. The delinquency rate decreased by 125 basis points for conventional loans, decreased 392 basis points for FHA loans and decreased 225 basis points for VA loans from the previous year.

–The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 0.59 percent, up 6 basis points from the first quarter of 2022 and 8 basis points higher than one year ago. The foreclosure inventory rate remains below the quarterly average of 1.43 percent dating back to 1979.

–The percentage of loans on which foreclosure actions were started in the second quarter fell by 1 basis point to 0.18 percent. The foreclosure starts rate remains below the quarterly average of 0.41 percent dating back to 1979.

–The non-seasonally adjusted seriously delinquent rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 2.12 percent. It decreased by 27 basis points from last quarter and decreased by 191 basis points from last year. The seriously delinquent rate decreased 19 basis points for conventional loans, decreased 69 basis points for FHA loans, and decreased 32 basis points for VA loans from the previous quarter. Compared to a year ago, the seriously delinquent rate decreased by 127 basis points for conventional loans, decreased 484 basis points for FHA loans and decreased 219 basis points for VA loans.

–States with the highest quarterly decreases in their overall delinquency rate were: New York (38 basis points), Hawaii (34 basis points), DC (30 basis points), Nevada (29 basis points), and Louisiana (29 basis points).

The NDS covers 39 million loans on one- to four- unit residential properties. Loans surveyed were reported by over 100 servicers, including independent mortgage companies, and depositories such as large banks, community banks and credit unions.