Homebuyer Competition At 2-Year Low

Six months ago, prospective homebuyers across the country faced stiff competition from each other, with homes for sale receiving multiple, escalating bids. What a difference a few months make.

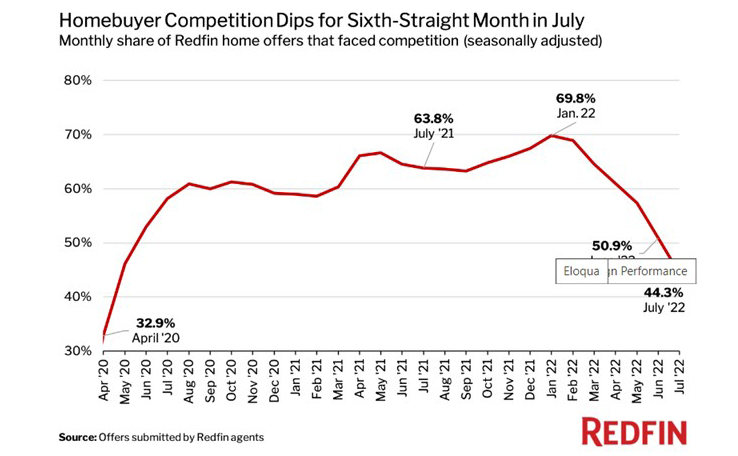

Redfin, Seattle, reported homebuyer competition fell for the sixth straight month in July, with fewer than half of homes receiving multiple offers. Just 44.3 percent of home offers written by Redfin agents saw competition—the sixth straight monthly decline to the lowest share on record since April 2020, at the onset of the coronavirus pandemic.

By comparison, just a month ago more than half (50.9 percent) of home offers faced competition; a year ago, nearly two-thirds (63.8 percent) of home offers faced competition. Redfin reported the typical home in a bidding war received 3.5 offers in July, compared to 4.1 one month earlier and 5.3 one year earlier.

Redfin noted homebuyer competition is cooling as more Americans are priced out of the housing market due to higher mortgage rates and inflation. Properties are lingering on the market longer and the housing shortage is easing up, giving buyers more options to choose from and room to negotiate. Some sellers are slashing their asking prices as a result. Roughly 8% of listings on the market each week experience a price cut, the highest share on record.

“The market is wildly different than it was a few months ago. Buyers are competing with one to two other offers instead of four to eight. Some aren’t facing competition at all,” said Alexis Malin, a Redfin real estate agent representing buyers in Jacksonville, Fla. “There’s not the same sense of urgency. House hunters are scheduling tours four days in advance instead of one, and they’re becoming much more selective. If a home doesn’t check all of their boxes, they’re waiting until they find one that does. Six months ago, buyers were taking any house they could get.”

Malin said buyers have also started writing offers for less than sellers’ list prices—a reversal from the height of the pandemic, when homes were going for tens of thousands of dollars over asking.

Redfin reported in Phoenix, just over one-fourth (26.6%) of home offers written by Redfin agents encountered competition in July—the lowest share among the 36 U.S. metropolitan areas Redfin analyzed. Rounding out the bottom five were Riverside, Calif. (31%), Seattle (31.5%), Austin, Texas (31.7%) and Nashville, Tenn. (33.3%). Many of these areas attracted scores of out-of-town homebuyers during the pandemic, pushing up prices and rendering them prohibitively expensive for some house hunters—one reason they now have relatively low bidding-war rates. The average out-of-towner moving to Nashville last year had $736,900 to spend on a home, 28.5% higher than average budget for local buyers—the largest gap among U.S. cities recently analyzed by Redfin.

Raleigh, N.C. had the highest bidding-war rate, at 63.8%. Next came Honolulu (63%), Providence, R.I. (60.5%), Philadelphia (60.4%) and Worcester, Mass. (54.8%).

Redfin said in Orlando, Fla., 37.4% of home offers written by Redfin agents faced competition in July, roughly half of the 81.4% rate seen a year earlier. That 44-percentage-point decline was the largest among the 36 metros in this analysis. It was followed by Nashville (33.3% vs. 73.1%; -39.7 ppts), Sacramento, Calif. (34.3% vs. 73.3%; -39 ppts), Charlotte, N.C. (34.6% vs. 71%; -36.4 ppts) and Colorado Springs, Colo. (36.8% vs. 71.2%; -34.3 ppts).

The report said townhouses were more likely than any other property type to face bidding wars, with 43.5% of Redfin offers encountering competition in July. Next came single-family homes (42.9%), condos/co-ops (39.7%) and multi-family properties (38.9%).

Some homebuyers have sought out townhouses, which are typically smaller and more affordable, because they’re priced out of the market for single-family homes. The typical home that went under contract in March was 1,720 square feet, down 1.8% from 1,751 square feet a year earlier.