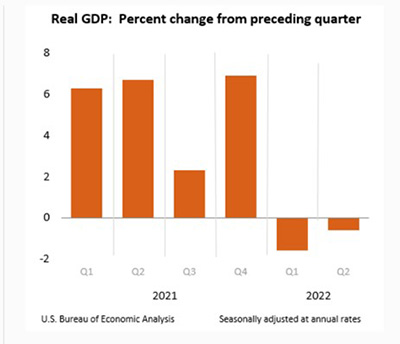

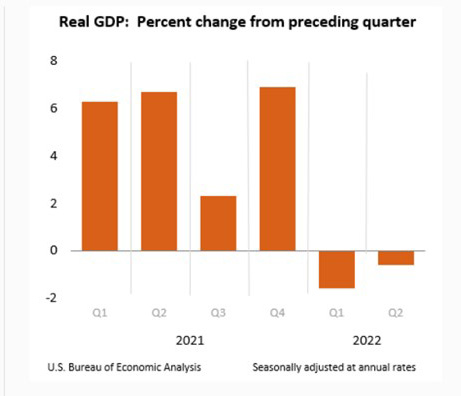

GDP: 2Q Pace of Slowing Decreases

The U.S. economy continued to slow in the second quarter, the Bureau of Economic Analysis reported Thursday, although not at a pace as dramatically earlier this summer.

BEA reported real gross domestic product decreased at an annual rate of 0.6 percent in the second quarter, according to the “second” (revised) estimate. In the first quarter, real GDP decreased 1.6 percent. The GDP estimate released Thursday was based on more complete source data than were available for the “advance” estimate issued in July. I n the advance estimate, the decrease in real GDP was 0.9 percent.

The report said the decrease in real GDP reflected decreases in private inventory investment, residential fixed investment, federal government spending and state and local government spending, partly offset by increases in exports and consumer spending. Imports, which are a subtraction in the calculation of GDP, increased.

The decrease in private inventory investment was led by a decrease in retail trade (mainly “other” general merchandise stores). The decrease in residential fixed investment was led by a decrease in “other” structures (specifically real estate brokers’ commissions). The decrease in federal government spending reflected a decrease in nondefense spending that was partly offset by an increase in defense spending. The decrease in nondefense spending reflected the sale of crude oil from the Strategic Petroleum Reserve, which results in a corresponding decrease in consumption expenditures. Because the oil sold by the government enters private inventories, there is no direct net effect on GDP. The decrease in state and local government spending was led by a decrease in investment in structures. The increase in imports reflected an increase in services (led by travel).

“Second quarter weakness still reflects a genuine slowing in economic activity, and we forecast the economy will fall into a mild recession by the beginning of next year,” said Jay Bryson, Chief Economist with Wells Fargo Economics, Charlotte, N.C. “While Q2 still marks the second-consecutive decline in real GDP growth, the upward revisions weaken the current recession argument.”