Scott Roller: A New Technology for Enterprise, Loan Officer Pipeline Building

(Scott Roller founded 3W Partners LLC and is Co-Founder of Vendor Surf LLC (www.VendorSurf.com), each dedicated to revolutionizing sourcing of vendors in the mortgage and credit union ecosystems. The companies monitor and report on the service provider market to provide participants what they need to excel in today’s market. He is a frequent contributor to MBA NewsLink.)

With the feeding frenzy of the Refi Boom just ended, where even mediocre mortgage lenders had years of overflowing pipelines, the market has flipped. The meal train has left the station, leaving chronic indigestion behind. The Fed’s actions and future rate increase projections have confirmed lenders must now go on the offensive – proactive actions to drive volume.

Traditionally, when this market flip occurs, intense pressure is bestowed upon lender sales and marketing teams. Everyone looks for them to become the ‘rainmakers.’ Pressures are often proportionate to the size of the lender, because few big banks invest in local purchase market referral relationships year-round. There is a fresh new approach to supplement the lender playbook, both at the enterprise and loan officer level.

Marketing teams have long been perfecting their trade and tools. Simply put, there are not many new whistles and bells. However, there is substantial opportunity in advertising technology.

We recently discovered Adwerx (www.Adwerx.com), the only enterprise grade software able to humanize marketing at scale, providing automated digital advertising for over 500 enterprises with over 400,000 individual users. They specialize in providing personalized advertising for distributed sales teams across real estate, wealth management, financial services – and now mortgage.

In mid-2020, after growth in other sectors, Adwerx deployed its unique FaceForward advertising methodology in the mortgage space. In less than 18-months, Adwerx has already signed 28% of Scotsman Guide’s Top 25 originator enterprises. That is impressive by any standard, but also rather extraordinary. This was during the height of the historic Refi Boom when lenders were ‘all hands on deck’ processing unprecedented volumes, with little attention elsewhere. Most vendors got the hand-in-the-face, hearing, “Try reaching out next year.” Apparently, Adwerx instead received a welcoming reception. Proven solutions are always in season.

Most conventional advertising is only done at an enterprise level, showcasing the brand. Marketing tactics used to be much the same, but mortgage marketing matured over time to humanize down to a salesperson level, with personal photos, signatures, links to calendars and more. Jed Carlson, Adwerx CEO, thought why not revolutionize advertising with a similar humanizing methodology. This solves two major pain points for lenders – automating enterprise level brand advertising and enabling corporate control and compliance, while also leveraging the same efficiency and effectiveness for individual LOs.

Adwerx templates are based on the psychological principles of trust and empathy that drive consumer behavior. Adwerx delivers the customized ads across premium websites, Facebook, Instagram and mobile apps. The result – driving brand visibility and growth through automation that boosts productivity by 15%. The solution also reduces turnover by 42%, as sales producers are not prone to leave behind one-of-a-kind results-producing technology. There are already documented cases where highly sought-after LOs required the Adwerx platform as part of the recruitment process. It is always compelling to amass a following of disciples, out spreading the word.

Studies show that 91.7% of ads featuring a person’s face attracted more attention than non-face ads. Carlson said, “Customer Relationship Advertising™ is rooted in a basic concept that people buy from people. You would not publish a salesperson email without personalization, so why do that with your advertising? Adwerx is the logical complement to your CRM and clients love it because it is fully automated.”

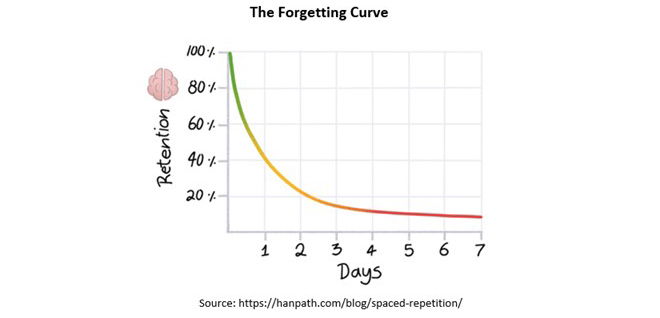

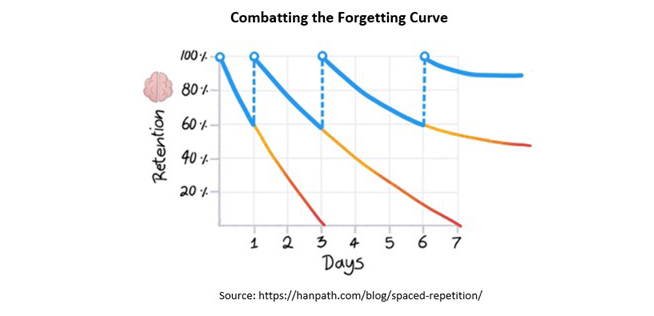

Adwerx educates on the psychology of recall using the theory of the ‘forgetting curve,’ which suggests that just three days after seeing your email or ad the consumer will retain less than 20% of the content.

For someone to recall the enterprise (brand) or the LO (name) and the product or service provided (home loans), repeated message frequency is essential. Marketing refined this tactic long ago, now the same is possible with humanized, personal advertising. Frequent, passive exposure to your message is the way to overcome the forgetting curve. LOs must be ‘seen’ in the online places where targeted prospects ‘hang out.’ This establishes LO familiarity – the personalized ads passively ‘follow’ each prospect as they browse the Web and social media – always keeping the LO top of mind.

After spending time with Carlson and his team, here are key value propositions we think lenders should understand:

- Customization – Template rules and workflow built for any channel, team or product

- Control – Assign template ownership as desired

- Compliance – Lenders can ‘set it and forget it’ – always in compliance

- Integrated – Sync with other enterprise data resources (i.e., CRM, etc.)

- Intelligent – Detects when LOs join or leave; Ads automatically adjust accordingly

- Automated – Reach all target audiences effortlessly

Carlson was asked about the reasons behind the rapid adoption by top mortgage lenders. He replied, “Our platform keeps the brand and their LOs visible in places they need to be, increases productivity, is powerful for recruitment and LO retention and delivers simplified compliance.” Carlson went on to emphasize the importance of staying top of mind with prospects, past clients and referral networks. He said Adwerx integrates well and automates everything, which marketers absolutely love because LOs don’t have to do anything.

We know readers always want to know about the required administrative resources and costs. Not surprisingly, these components were as well-designed as the platform itself. Carlson said that once customizable templates are established, they essentially run themselves until clients want to make adjustments. There is something about ‘zero dedicated headcount’ that sounds quite nice. Costs are highly flexible too, depending upon client channel strategy and budget. One client may want ads to appear 10 times a week on the consumer’s devices, while another client may opt for three per week. Some might want to only target hottest prospects or just past clients. Adwerx often plays a consultative role to help clients design effective approaches.

In closing, we asked Carlson about target markets for Adwerx. He said they are always busy onboarding clients of all sizes, clarifying they do not partner exclusively with the Scotsman Guide’s Top 25. They work with lenders having as few as 5-to-10 salespeople. Carlson said on the product side of things, Adwerx is currently building out more tools for the marketers who use the platform. There is no finish line when it comes to delivering innovation, insights, control and options.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)