Fitch: Weaker Borrowers in U.S. Securitizations Vulnerable to Inflation

MBA NewsLink Staff

Fitch Ratings, New York, said inflation and rising rates will pressure consumers, with the greatest burden on households with low incomes and savings and who have not fully recovered from pandemic-related financial stresses.

The report, Most Borrowers in U.S. Securitizations are Well-Positioned for Inreasing Macro Risks, noted, however, strong macroeconomic recovery over the past two years has led to robust employment growth and increased savings, particularly for higher-income individuals. Fitch expects structured finance asset performance to remain resilient.

“The strong structured finance asset performance metrics observed during the pandemic are returning to pre-pandemic levels, and we expect any increases in defaults to continue to be limited due to overall healthy consumer indicators and strong asset values,” the report said. “Securitizations backed by weaker borrowers, such as retail credit cards, certain marketplace lending/unsecured loans and subprime auto, will be more vulnerable to asset-performance deterioration, given rising prices and increasing debt service costs that will erode borrowers’ disposable income.”

The report said most Fitch-rated consumer loan securitizations contain loans to prime borrowers, “who are better positioned to manage inflationary pressures due to higher savings and higher rates of homeownership.”

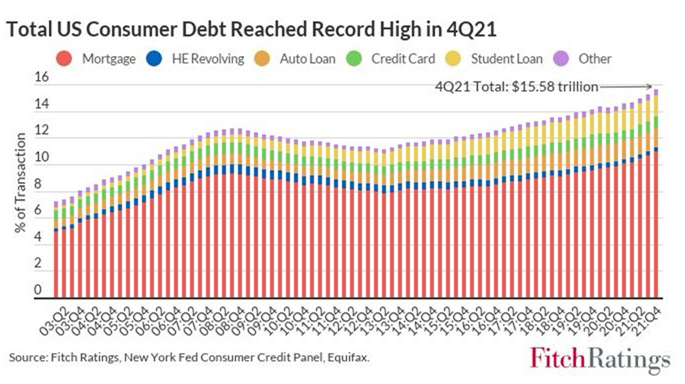

The report said total U.S. consumer debt reached a record $15.58 trillion in the fourth quarter, primarily due to the rise in mortgages, auto loans and credit card debt.

“Interest rate hikes will have a cooling effect on consumer spending and housing demand, slowing economic and home price growth,” the report said. “While the majority of mortgages and other consumer loans are fixed-rate, rising rates will increase debt burdens for new borrowers and those with variable-rate obligations, potentially affecting repayment of other loans. Higher rates will also increase loan refinancing challenges for borrowers with lower credit quality.”

Additionally, Fitch said the potential for “very aggressive” monetary tightening, continued waves of new coronavirus variants or an unexpected slowdown in economic growth leading to a significant increase in unemployment beyond its forecast “would erode consumer health and likely have negative impact on asset performance.”

“U.S. consumers have been resilient throughout the pandemic, but they will face new financial stresses as inflationary pressures grow,” the report said. “High inflation will compound the strain on low-income households without savings, as well as those that have not fully recovered from pandemic-related financial stresses…higher rates will also increase loan refinancing challenges for borrowers with lower credit quality. U.S. consumer asset performance has remained strong throughout the pandemic, supported by federal supplemental unemployment benefits and lender payment-relief programs, most of which expired in 2021.”