March Jobs Report Continues Strong Trend

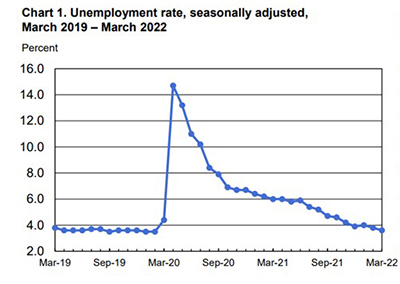

U.S. employers added 431,000 jobs in March, the Bureau of Labor Statistics reported Friday, while the nation’s unemployment rate fell to 3.6 percent.

The report said the number of unemployed persons decreased by 318,000 to 6.0 million. The unemployment rate and the number of unemployed persons nearly match pre-pandemic numbers, BLS said (3.5 percent and 5.7 million, respectively).

BLS revised total nonfarm payroll employment for January up by 23,000, from +481,000 to +504,000, and for February up by 72,000, from +678,000 to +750,000. With these revisions, employment in January and February combined is 95,000 higher than previously reported.

The labor force participation rate, at 62.4 percent, fell slightly in March. The employment-population ratio increased by 0.2 percentage point to 60.1 percent. Both measures remain below their February 2020 values (63.4 percent and 61.2 percent, respectively).

“March was another strong month for the job market,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “Job gains were well above what can be sustained for the longer term, the unemployment rate dropped – despite a small increase in labor force participation, and wage growth increased again. Furthermore, the job gains for both January and February were revised higher.”

Fratantoni noted while employment remains 1% below February 2020 levels, the gap is closing, with increases averaging 562,000 per month in the first quarter. “The rapid drop in the unemployment rate says that the pool of potentially available workers continues to drain quickly,” he said. “With the large number of job openings reported in the most recent data, there will continue to be significant upward pressure on wages, with wage growth over the last 12 months running at 5.6%.”

Fratantoni said in addition to strong job gains, employment disruptions caused by the pandemic also continue to show improvement: only 10% of workers reported teleworking due to the pandemic in March, down from 13% in February and less than half the level from its peak. “As the federal government and others return to work in April, this number should drop sharply, which may well lead to further job changes in retail, professional services, and other sectors that are dependent on in-person work,” he said. “This is good news for commercial real estate lenders and investors.”

Additionally, Fratantoni noted although mortgage rates have spiked more than half a percentage point over the past two weeks, reducing affordability for many potential first-time homebuyers, the increase in wages will certainly somewhat help offset that hurdle. “And the confidence that many potential homebuyers have in their financial situation also benefits from this historically strong job market,” he said. “We continue to expect that the Federal Reserve will move rates up expeditiously to counter surging inflation, and that this report only adds more urgency to their plans to do so.”

“The strong pace of hiring is being supported by rising labor force participation but is still plenty strong enough to keep the labor market tightening,” said Sarah House, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “While the jobs market is not the Fed’s number one priority at present, today’s solid report supports the prospect of a 50 bp increase in the fed funds rate at the FOMC’s May meeting.”

“Approximately 93% of the jobs lost in the pandemic have been regained,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “If monthly gains continue at the March pace, we could return to the pre-COVID employment peak by July.”

Kushi noted residential building construction employment declined by 2,600 in March, while non-residential picked up by 2,600. Residential building employment is up 6% compared with pre-pandemic levels, while non-residential building employment remains 5.6% below. “There was a big increase in hiring for residential specialty trade contractors this month (+10,200), while residential building dipped slightly,” she said. “Overall, a net gain of 7,600 jobs for residential construction, which is good news for this labor-intensive industry and for the prospect of more housing supply.”

The report said average hourly earnings for all employees on private nonfarm payrolls rose by 13 cents to $31.73 in March. Over the past 12 months, average hourly earnings have increased by 5.6 percent. In March, average hourly earnings of private sector production and nonsupervisory employees rose by 11 cents to $27.06.

“The construction industry faces a shortage of skilled workers, and one way to attract and retain employees is to pay more,” Kushi said.

BLS said the average workweek for all employees on private nonfarm payrolls fell by 0.1 hour to 34.6 hours in March. In manufacturing, the average workweek for all employees was unchanged at 40.7 hours, and overtime fell by 0.1 hour to 3.4 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls declined by 0.1 hour to 34.1 hours.