March Mortgage Credit Availability Edges Down

Mortgage credit availability fell slightly in March, the Mortgage Bankers Association reported Thursday.

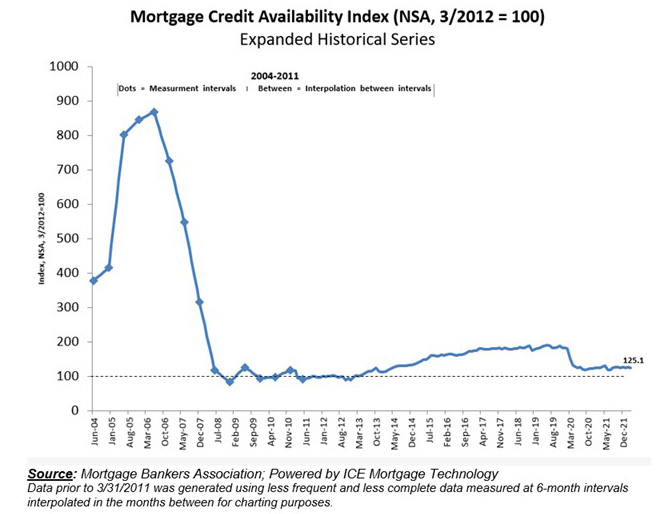

The MBA Mortgage Credit Availability Index fell by 0.7 percent to 125.1 in March. The Conventional MCAI increased 0.3 percent, while the Government MCAI decreased by 1.6 percent. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 1.5 percen, and the Conforming MCAI fell by 1.9 percent.

“Overall credit availability was down slightly in March, driven by a reduction in higher LTV and lower credit score programs,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “Credit availability has gradually trended higher since mid-2021 but remains around 30 percent tighter than it was in early 2020.”

Kan also noted mixed trends for the various loan categories. “Conventional loan credit availability increased for the second month in a row, while government credit supply decreased to its tightest level since February 2014,” he said. “Additionally, jumbo credit expanded for the tenth time in the past 12 months but remained almost 40 percent lower than the pre-pandemic level.”

The report analyzes data from Ellie Mae’s AllRegs® Market Clarity® business information tool. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012.

About the Mortgage Credit Availability Index

The MCAI provides the only standardized quantitative index solely focused on mortgage credit.

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for more than 95 lenders/investors are combined by MBA using data made available via the AllRegs Market Clarity product and a proprietary formula derived by MBA to calculate the MCAI, a summary measure which indicates the availability of mortgage credit at a point in time. Base period and values for total index is March 31, 2012=100; Conventional March 31, 2012=73.5; Government March 31, 2012=183.5.

To learn more about the ICE Mortgage Technology AllRegs Market Clarity platform, visit http://answers.allregs.com/MCAI-Market-Clarity. For more information on the Mortgage Credit Availability Index, including Methodology, Frequently Asked Questions and other helpful resources, visit www.mba.org/MortgageCredit or contact MBAResearch@mba.org.