International Investors Target Smaller U.S. Cities

International investors feel increasingly optimistic about U.S. commercial real estate, sparking increased interest in secondary and tertiary markets, said the Association of Foreign Investment in Real Estate, Washington, D.C.

The AFIRE 2022 International Investor Survey Report found an overall positive outlook for U.S. real estate assets among global investors.

AFIRE CEO Gunnar Branson said the annual survey looked at the longer-term impact the pandemic had on real estate investment and found “altered cultural attitudes and sustained strength in investment in secondary and tertiary U.S. cities, led by Austin, Atlanta, Boston and Dallas.”

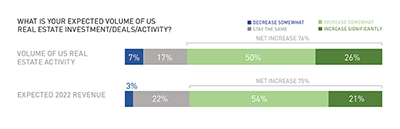

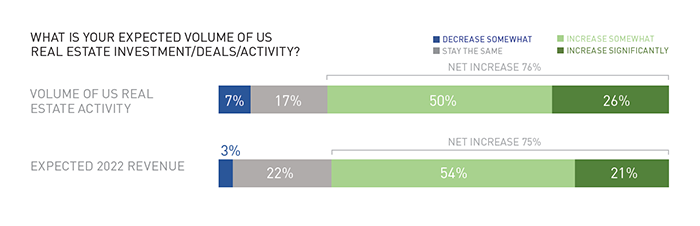

Nearly three-quarters of international investors said they expect their volume of U.S. real estate investment activity and revenue to increase throughout 2022, the report said. Nearly eight in 10 reported they plan to increase their U.S. real estate investment over the next three to five years.

AFIRE said 90 percent of those surveyed plan to increase their investment in multifamily assets over the next three to five years, followed by life sciences (77 percent) and industrial properties (75 percent).

The report found environmental, social and governance criteria are growing more important to investors every year. More than 80 percent of those surveyed indicated ESG criteria would be “very important” over the next five years, up from 69 percent in 2021. Carbon footprint reduction measures (90 percent) and “actionable” climate change strategies (89 percent) ranked as the most important ESG priorities for U.S. real estate investments in the near future. Diversity (74 percent) followed environmental factors among ESG trends.

AFIRE reported nearly nine in 10 respondents recognize the future financial benefit of taking action now on ESG. “Notably, more than half of respondents agree that they would accept a lower than expected rate of return if it meant realizing other social or environmental benefits,” the report said.