Initial Claims Hold Near 52-Year Lows; Leading Economic Indicators Improve

MBA NewsLink Staff

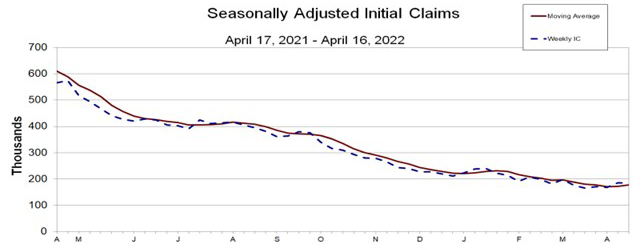

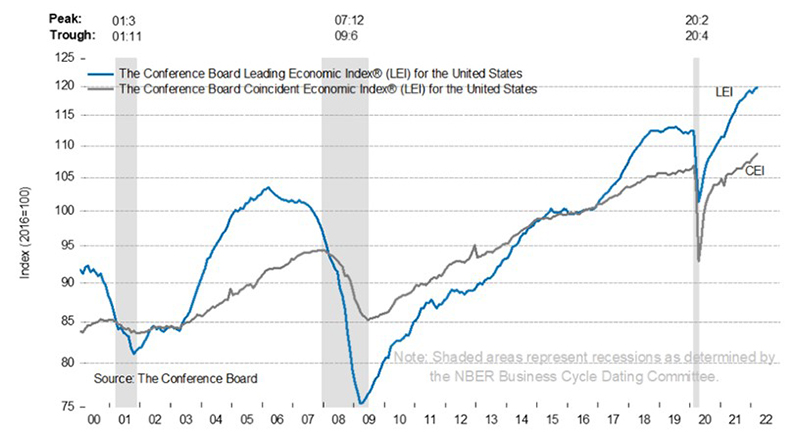

Initial claims for unemployment insurance hovered near historic lows last week, the Labor Department reported Thursday. In a separate report, the Conference Board, New York, reported its Leading Economic Index rose in March, the second consecutive monthly improvement.

Labor reported for the week ending April 16, the advance figure for seasonally adjusted initial claims fell to 184,000, a decrease of 2,000 from the previous week, which revised up by 1,000 from 185,000 to 186,000. The four-week moving average rose to 177,250, an increase of 4,500 from the previous week’s revised average.

The advance seasonally adjusted insured unemployment rate fell to 1.0 percent for the week ending April 9, a decrease of 0.1 percentage point from the previous week’s unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending April 9 fell to 1,417,000, a decrease of 58,000 from the previous week’s unrevised level of 1,475,000 to its lowest level since February 21, 1970, when it was 1,412,000. The four-week moving average fell to 1,481,750, a decrease of 31,250 from the previous week’s revised average to its lowest level since March 21, 1970, when it was 1,456,750.

The advance number of actual initial claims under state programs, unadjusted, totaled 196,897 in the week ending April 16, a decrease of 27,235 (12.2 percent) from the previous week. The seasonal factors had expected a decrease of 24,800 (11.1 percent) from the previous week. Labor reported 583,397 initial claims in the comparable week in 2021.

The advance unadjusted insured unemployment rate was unchanged at 1.1 percent during the week ending April 9. The advance unadjusted level of insured unemployment in state programs totaled 1,475,585, a decrease of 95,550 (6.1 percent) from the preceding week. The seasonal factors had expected a decrease of 35,406 (2.3 percent) from the previous week. A year earlier the rate was 2.7 percent; volume was 3,828,584.

The total number of continued weeks claimed for benefits in all programs for the week ending April 2 was 1,622,094, a decrease of 88,031 from the previous week. Labor reported 17,394,057 weekly claims filed for benefits in all programs in the comparable week in 2021.

Meanwhile, The Conference Board Leading Economic Index for the U.S. increased by 0.3 percent in March to 119.8, following an 0.6 percent increase in February. The LEI increased by 1.9 percent in the six-month period from September 2021 to March 2022.

The Coincident Economic Index for the U.S. increased by 0.4 percent in March to 108.7, following an 0.4 percent increase in February. The CEI increased by 2.2 percent in the six-month period from September 2021 to March 2022.

The Lagging Economic Index for the U.S. increased by 0.6 percent in March to 110.9, following an 0.2 percent increase in February. The LAG increased by 2.0 percent in the six-month period from September 2021 to March 2022.

“The U.S. LEI rose again in March despite headwinds from the war in Ukraine,” said Ataman Ozyildirim, Senior Director of Economic Research with The Conference Board. “This broad-based improvement signals economic growth is likely to continue through 2022 despite volatile stock prices and weakening business and consumer expectations.”

“Sinking consumer expectations essentially netted out a boost from the interest rate spread, but overall strength was broad-based,” said Tim Quinlan, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “Jobless claims reached an over 50-year low last month and rose back into the upper echelon of contributors, however, between continued supply headwinds and the onset of monetary policy tightening, we expect slower growth ahead.”