CMBS Delinquency Rate Drops Sharply

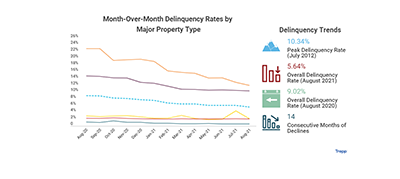

(Chart courtesy Trepp LLC)

The commercial mortgage-backed securities delinquency rate declined sharply in August, posting the largest drop in six months, reported Trepp LLC, New York.

The overall CMBS delinquency rate equaled 5.64 percent in August, down 47 basis points from July.

“The August number represented a sizable decline after several months of mostly modest improvements,” said Manus Clancy, Senior Managing Director with Trepp. He noted the delinquency rate has now fallen for 14 consecutive months after two huge jumps in May and June.

Clancy said 2.42 percent of loans by balance missed their August payment but remained less than 30 days delinquent. That figure was down 51 basis points for the month.

Fitch Ratings, New York, said continued strong resolution volume, fewer new delinquencies and “robust” new issuance caused the CMBS delinquency rate to drop. Resolutions totaled $1.6 billion in August while new delinquencies equaled $610 million, the lowest monthly volume since April 2020. Fitch reported 30-day delinquencies fell to $1.9 billion from $2.5 billion in July.

Fitch said the hotel sector had the highest delinquency rate at 11.56 percent (down from 13.61 percent in July); the retail sector also had an elevated delinquency rate at 8.43 percent, down from 9.14 percent in July. The industrial sector reported the lowest delinquency rate, just 0.17 percent, down from 0.18 percent a month before.

Trepp Research Analyst Maximillian Nelson said the CMBS special servicing rate fell 35 basis points in August to 7.79 percent. “According to August remittance data, four of the five major property types saw decreases in their special servicing reading,” he said. “The largest improvements were concentrated in the lodging and retail sectors.”

The lodging sector’s special servicing rate dropped from 17.95 percent in July to 17.40 percent in August, Nelson said. The retail sector reading fell 48 basis points to 14.18 percent. Retail’s special servicing rate has improved by 313 basis points over the last 12 months, he said.