Life Insurance Commercial Mortgage Returns Bounce Back

Trepp LLC, New York, said commercial mortgage investments held by life insurance companies bounced back in the second quarter after turning negative in early 2021.

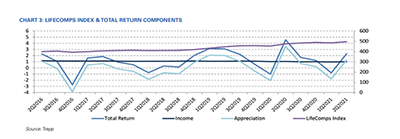

The Trepp LifeComps report found life company commercial mortgage investments posted a 2.29 percent total return in the second quarter, up from a -0.80 percent total return in the first quarter.

The data firm attributed the positive total return to a significant increase in reported loan values. Loan values rose to 1.28 percent in quarter two from -1.77 percent in the first quarter. The report noted the turnaround ends a relatively slow decline over the prior three quarters.

“With the economy running hot, the market anticipates changes impacting consumer wages and ramifications on commercial real estate investments,” said Jennifer Dimaano, Trepp Data Analyst. “The more prolonged impact of structural changes from COVID-19 on CRE investments remains unclear, but as the economy reopens, the market looks to be heading toward normalcy in the near term.”

Lodging properties performed best over the past 12 months with a 6.47 percent total return as summer travel resumed in May and June, Trepp said. Office property charge-offs declined noticeably, “signaling the beginning of a return to the office,” the report said.

The Trepp LifeComps Index tracks nearly 8,000 active loans with a $155 billion aggregate principal balance and a 5.19 year weighted-average duration.

Last week Fitch Ratings, New York, said potential stress on U.S. life insurers’ commercial mortgage portfolios will not drive rating downgrades due to the industry’s strong capitalization, current loan quality and historical loss experience.

Commercial mortgage loans make up nearly 13 percent of life company’s total invested assets. Fitch estimated the top 15 U.S. life insurers by commercial mortgage loan exposure could absorb a nearly 60 percent aggregate default rate–14 times the default rate insurers saw during the Great Recession–rate given their current capitalization.