Share of Mortgage Loans in Forbearance Decreases to 2.21%

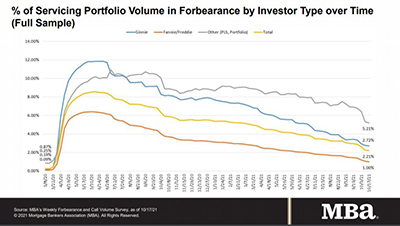

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 7 basis points to 2.21% of servicers’ portfolio volume as of October 17 from 2.28% the week before. MBA estimates 1.1 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 5 basis points to 1.00%. Ginnie Mae loans in forbearance decreased 5 basis points to 2.72%, while the forbearance share for portfolio loans and private-label securities declined 13 basis points to 5.21%. The percentage of loans in forbearance for independent mortgage bank servicers decreased 8 basis points to 2.49%, while the percentage of loans in forbearance for depository servicers decreased 5 basis points to 2.11%.

“Following two weeks of rapid declines, the share of loans in forbearance dropped again, but at a reduced rate,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “As reported in the past, many servicers process forbearance exits at the beginning of the month, therefore it is not surprising to see the pace of exits slow again mid-month. The composition of loans in forbearance is evolving. More than 25% of loans in forbearance are now made up of new forbearance requests and re-entries, while many other homeowners who have reached the end of 18-month terms are successfully exiting into deferrals or modifications.”

Key findings of MBA’s Forbearance and Call Volume Survey – October 11-17

- Total loans in forbearance decreased by 7 basis points from last week: 2.28% to 2.21%.

- By investor type, the share of Ginnie Mae loans in forbearance decreased from 2.77% to 2.72%.

- The share of Fannie Mae and Freddie Mac loans in forbearance decreased from 1.05% to 1.00%.

- The share of other loans (e.g., portfolio and PLS loans) in forbearance decreased from 5.34% to 5.21%.

- By stage, 15.3% of total loans in forbearance are in the initial forbearance plan stage, while 74.8% are in a forbearance extension. The remaining 9.9% are forbearance re-entries.

- Total weekly forbearance requests as a percent of servicing portfolio volume (#) remained unchanged at 0.04%.

- Of the cumulative forbearance exits for the period from June 1, 2020, through October 17, 2021, at the time of forbearance exit:

- 29.1% resulted in a loan deferral/partial claim.

- 20.7% represented borrowers who continued to make their monthly payments during their forbearance period.

- 16.7% represented borrowers who did not make all of their monthly payments and exited forbearance without a loss mitigation plan in place yet.

- 13.0% resulted in a loan modification or trial loan modification.

- 12.1% resulted in reinstatements, in which past-due amounts are paid back when exiting forbearance.

- 7.1% resulted in loans paid off through either a refinance or by selling the home.

- The remaining 1.3% resulted in repayment plans, short sales, deed-in-lieus or other reasons.

- Weekly servicer call center volume:

- As a percent of servicing portfolio volume (#), calls increased from 7.4% to 7.7%.

- Average speed to answer decreased from 2.6 minutes to 2.1 minutes.

- Abandonment rates decreased from 6.0% to 5.7%.

- Average call length decreased from 8.3 minutes to 7.9 minutes.

- Loans in forbearance as a share of servicing portfolio volume (#) as of October 17:

- Total: 2.21% (previous week: 2.28%)

- IMBs: 2.49% (previous week: 2.57%)

- Depositories: 2.11% (previous week: 2.16%)

MBA’s latest Forbearance and Call Volume Survey represents 73% of the first-mortgage servicing market (36.7 million loans). To subscribe to the full report, go to www.mba.org/fbsurvey.

If you are a mortgage servicer interested in participating in the survey, email fbsurvey@mba.org.