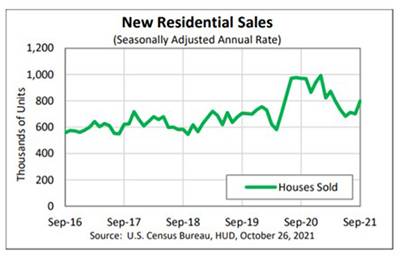

September New Home Sales Post Strong 14% Increase

New home sales jumped by 14 percent in September, HUD and the Census Bureau reported Tuesday, showing no signs of the traditional fall slowdown.

The report said sales of new single‐family houses in September rose to a seasonally adjusted annual rate of 800,000, 14 percent higher than the revised August rate of 702,000, but 17.6 percent lower than a year ago (971,000).

Regionally, results were positive month over month, but not so much year over year. In the largest region, the South, sales rose by 17.5 percent in September to 498,000 units, seasonally annually adjusted, from 424,000 units in August; from a year ago, sales fell by nearly 12 percent. In the West, sales rose by 8.2 percent to 197,000 units in September from 182,000 units in August but fell by nearly 28 percent from a year ago.

In the Northeast, sales jumped by 32.3 percent in September to 41,000 units, seasonally annually adjusted, from 31,000 units in August and improved by 7.9 percent from a year ago. Only the Midwest saw a monthly decline (-1.5 percent) to 64,000 units in September from 65,000 units in August; from a year ago, sales in the Midwest fell by 34 percent.

“Concerns that a slowdown in housing activity was underway appear to have been unwarranted; new home sales easily topped expectations,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “The robust gain in new home sales follows last week’s news of a similarly strong upturn in existing home sales during September. Taken together, these reports offer evidence that buyer demand remains strong and is picking up again, even amid fast-rising prices and low inventory levels.”

Kushi said September’s strong gain in new home sales provides the first sign that the many supply constraints currently affecting builders may be starting to ease. “Since peaking in the spring, lumber prices have come down markedly,” she said. “Lumber accounts for a significant share of the overall cost of new home construction, so builders are likely under less pressure to pass on rising costs through higher prices…While builders may be finding ways to navigate around the mounting supply-side challenges, it is by no means smooth sailing. Tangled supply chains caused by shortages of shipping containers, cargo space and transportation workers have led to increasingly long lead-times for procuring many building materials. The inability to find qualified workers has compounded the issue, leading to extended project timelines and delayed completions.”

Mark Vitner, Senior Economist with Wells Fargo Economics, Charlotte, N.C., agreed. “The monthly surge in sales, which easily topped consensus estimates, is a sign that builders are finding ways to navigate around shortages of building materials and qualified labor,” he said. “The robust pace of activity will calm concerns that the slowdown in sales experienced during the spring would extend throughout the remainder of the year.”

However, Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C., noted while the size of the increase was more than expected, “the data series tends to be volatile, and it coincided with sizable downward revisions to the prior two months.”

“Taken as a whole, the report continues to reflect the ongoing story of strong housing demand confronting a tight supply of homes available for sale, as homebuilders face difficulties working through their order backlogs,” Duncan added. “The good news is that despite the jump in sales, the total amount of homes left for sale at the end of the month remained flat at the highest level since 2008, suggesting homebuilders are finding sufficient lots to generate a higher pace of sales going forward. However, ongoing supply chain disruptions and labor scarcity are limiting the pace of construction completions.”

HUD/Census reported the median sales price of new houses sold in September rose to $408,800 from $401,000 in August. The average sales price rose to $451,700 in September from $443.000 in August. The seasonally adjusted estimate of new houses for sale at the end of September was unchanged at 379,000, representing a supply of 5.7 months at the current sales rate.