CoreLogic: 37.2% National Year-Over-Year Increase in Mortgage Fraud Risk

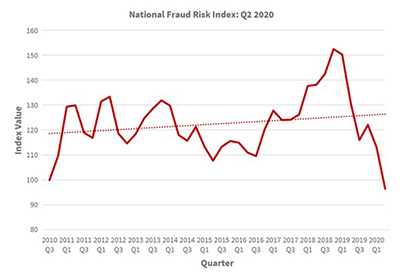

CoreLogic, Irvine, Calif., said its quarterly Mortgage Fraud Report showed a 37.2% year-over-year increase in fraud risk at the end of the second quarter.

Ann Regan, Executive in Product Management with CoreLogic, said the significant increase for mid-2021 follows a large drop seen in 2020 – a decrease driven mainly by the surge in traditionally low-risk refinances during the pandemic. The current risk level is similar to mid-2019.

The report said during the second quarter, 0.83% of all mortgage applications contained fraud, or one in 120 applications. A year ago, the estimate was 0.61% or one in 164 applications. Continued low mortgage rates and a record volume of refinances pushed the overall fraud risk down. However, risk in the purchase segment increased 6%, with investment properties driving the highest risk in both purchase and refinance populations.

“Refinance opportunities that surged lending volumes during the pandemic may be winding down. The outlook is for fewer low-risk refinances compared to purchases and cash-out refinances, which translates to a higher-risk environment for fraud,” Regan said.

Other report findings:

• Nationally, most fraud types showed increased risk. Transaction risk showed an increase of 34.2% year-over-year. Income and property fraud risk decreased slightly, aligning with the strong job market and home price growth.

• The top five states for risk increases include: South Dakota, Washington, Alaska, Vermont and West Virginia. Less-populous states are more volatile due to lower levels of lending activity. These states all had below-average index values in 2020.

• Nevada moved into the top position for mortgage application fraud risk, with New York, Hawaii, Florida and California rounding out the top five.