MBA Chart of the Week Oct. 25 2021: Commercial/Multifamily Lending

Sometimes research is like putting a puzzle together – trying to fit one piece of information with another to create a full picture of what’s happening. This week, we are adding a new, final piece to the puzzle of how much commercial real estate lending happens each year.

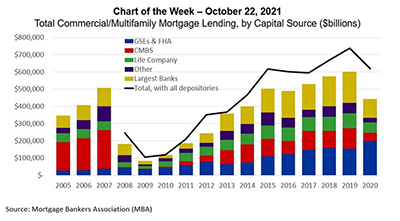

Each spring, MBA conducts a survey of commercial and multifamily mortgage banking firms to gather information on mortgage lending in the previous year. The survey collects essentially complete coverage of lending in the CMBS, GSE, FHA, life company and other space, as well as CRE lending by the largest depositories. Unfortunately, there is a significant portion of the bank and credit union lending market that goes unrecorded.

Since 2005, MBA has been able to fill this gap on the multifamily side by merging our survey data with data from the Home Mortgage Disclosure Act, which misses a great deal of the institutional lending the MBA survey picks up, but captures the small and mid-sized depositories the MBA survey misses. In 2020, $88 billion of HMDA-tracked multifamily loans were added to the $272 billion tracked in MBA’s survey to get a total multifamily lending volume of $360 billion – the most comprehensive assessment of multifamily lending available.

That same puzzle piece isn’t available for depository lending for other property types, but a new estimate from MBA is.

To better estimate multifamily lending (prior to the annual release of HMDA data) MBA has developed a new model to track the relationship between changes in bank-held multifamily mortgage debt outstanding and bank multifamily lending. By extending that model to total commercial and multifamily lending, MBA now has an estimate of depository lending that goes beyond the banks that participate in our annual survey – adding $178 billion of depository lending in 2020 to our $441 billion of mortgage bankers commercial and multifamily originations to get an estimate of $619 billion of total CRE lending in 2020.

- Jamie Woodwell (jwoodwell@mba.org)