Wuthering Heights: Rent Control Proposals Make the Rounds

(Andrew Foster is Associate Vice President in MBA’s Commercial/Multifamily Group. He is a former Analyst with S&P Global Ratings and Fitch Ratings as well as a regular contributor to MBA NewsLink. He can be reached at afoster@mba.org.)

A unique characteristic of the current real estate cycle is that it’s arguably been in the recovery phase since about 2010. Even while the events of 2020 put a pause on the economy, creating a significant downward shift in the labor market, many would agree that commercial real estate has not had a classic economic downturn since the Great Recession. That is important to consider in business planning generally, and specifically as apartment rents increase across the country. The drumbeat of calls for rent control have risen almost in tandem with rents.

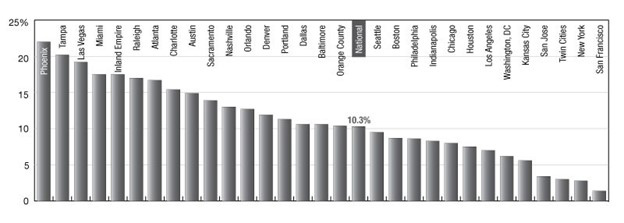

Multi-Housing News details here, “the national multifamily market continued its astounding performance, with asking rents posting the first-ever double-digit increase in Yardi Matrix’s dataset, up 10.3 percent year-over-year through August to $1,539.” While rents were clearly recovering after some decreases in many markets last year, questions around affordability have remained for some time despite price volatility.

Source: Yardi Matrix August Monthly Report

Square Peg Round Hole? The Case Against Rent Control

Some basic reasoning for opposing rent control is predicated on the fact that research based on real-life examples shows that rent control exacerbates housing shortages and disproportionally benefits higher-income households – and this ultimately hurts the families that need the most help. Moreover, rent control discourages investors from entering markets, effectively capping capital flows into and pushing rents higher in an often already expensive local rental market.

James Burling explains in an opinion piece for The Hill, found here:

“Most of us have learned that no rent control law, no matter how well-intentioned, has managed to repeal two fundamental laws of economics: the law of supply and demand and the law of unintended consequences. Virtually all economists from across the political spectrum agree that rent control reduces the housing supply and inevitably leads to shortage-induced price increases.”

Critics of rent control effectiveness often point to increasing supply as the more efficient mechanism to counteract the lack of affordability. The Mortgage Bankers Association recently published an environmental scan of affordable rental housing that highlights the nuanced set of challenges in this area including a description of problematic supply constraints.

As Rents Jump, Rent Control Can Look Tempting

Supporters of rent control strongly argue in the opposite direction. The below points were published The Hill column by Cea Weaver:

By curbing excessive rent hikes and preventing retaliatory or unjust eviction, rent control mitigates the power imbalance between tenants and landlords, advances overall neighborhood stability and prevents an eviction crisis as our cities become more expensive places to live. Despite decades of false “sky is falling” alarmism by the well-funded landlord lobby, rent control has done more to keep housing affordable and keep people in affordable housing than any other program in New York’s history. Nearly one million rent-regulated apartments house over 2 million renters with a median income of just $35,000, renters who would be either homeless or faced with crippling rent burdens without the protections that New York’s rent laws offer. And, as economist JW Mason has pointed out, recent studies of rent regulations have noted that its impact on housing has been largely exaggerated and that rent regulation has been extremely effective at limiting the cost of rent.

A Look at Where Rent Control Debates are Occurring

The following list are some examples of local and national press coverage of jurisdictions that have passed or are considering proposals for various forms of rent control. New York and California have been leaders in this debate; however, various other smaller urban areas are now in the debate.

Minneapolis/St. Paul—This November, for the first time, both Minneapolis and St. Paul have rent stabilization measures on the ballot. Minneapolis Post columnist Bill Lindeke provides details. Some key points are outlined below and analysis can be found here:

The Minneapolis proposal is short on details: The ballot measure is simply a legal “permission slip” allowing the City Council to implement rent stabilization in the future.

St. Paul, on the other hand, has the opposite situation. Thanks to the city’s ballot initiative rules, a proposal has already been written by a coalition of advocacy groups called Housing Equity Now Saint Paul. With nearly all the details laid out in writing, if it passes, the only thing left to city leaders would be the implementation of details of enforcement and variance regulation.

The St. Paul law would cap rent increases for all the city’s 65,000 rented homes at 3% per year but includes a complicated list of factors that allow landlords to apply for variances — things like property taxes, maintenance issues, capital improvements (only if needed to bring a building to code), and a few others.

A major issue with the proposal is that, unlike nearly everywhere else, newly built housing is not exempt. This is quite a change, as almost no rent control programs apply to new buildings. In the U.S., for example, all cities and states apply rent control only after a period: 15 years in Oregon, 30 years in New Jersey, or only for buildings built before an arbitrary year (1995 in California; 1974 in New York City).

Santa Ana, Calif.—During a Sept. 21 Santa Ana City Council meeting, officials moved forward on a measure curbing rent hikes and adding eviction measures. Council members fell short of voting to implement the measures immediately; however, they will have a second reading and vote at a future meeting.

The rent control ordinance seeks to impose a 3% annual rent increase cap on apartment complexes and mobile home parks. Read more details in Daily Pilot story here.

Mountain View, Calif.—The Mountain View City Council voted 6-1 Sept. 14 to enact rent control for mobile homes as detailed here.

The new law closely mirrors the city’s existing rent control law covering apartments and would cap annual rent increases at the rate of inflation, with a floor of 2% and a ceiling of 5%. The law also enforces eviction protections for tenants who rent mobile homes. Unlike apartment rent control, the new law also prevents park owners from increasing rent once a mobile home owner leaves and a new tenant moves in. So-called vacancy control — prohibited under state law for most types of housing — is allowed for mobile homes, and the City Council agreed to cap rent increases for new tenants at the consumer price index.

Seattle—Seattle landlords will soon have to provide six months’ notice of rent increases and, in some cases, pay tenants who move after a significant rent hike. The Seattle City Council approved two bills this month, the latest in a series of new landlord-tenant regulations including bans on some evictions and the right to an attorney for low-income tenants facing eviction. Landlords criticized the proposals, arguing they could push small-scale operators to sell their rentals.

The relocation assistance bill passed unanimously. That bill will require landlords to pay equal to three months of rent for low-income tenants who depart after rent increases of 10% or more. Landlords argued the bills amounted to rent control. “These bills do nothing to address our housing shortage and are just the latest in a string of bad ideas that have made housing more expensive over the last seven years,” the Rental Housing Association of Washington and the Washington Multifamily Housing Association said in a joint statement last week. Entire article can be found here.

Montgomery County, Md.—The law in question for Montgomery County would extend protections begun in response to pandemic. This bill would extend rent controls and forgiveness of late fees to 12 months from the past the end of the public health emergency. Given the billions in undistributed COVID-related rental assistance funds appropriated to the state by Congress and given the negative impact on landlords, there is strong opposition to the measure. The MBA grassroots industry network, Mortgage Action Alliance put out a call to action to oppose this bill on Sept. 22.

Looking Forward on Affordability Challenges

As we shift to a post-pandemic world with the ending of temporary measures, the rent control debate will be in focus as even more parts of the country are faced with shortages of affordable rental properties. The pressure for quick fixes that are not likely be effective medium to long term policy choices may increase as well.