ULI Survey Finds Continued Commercial Real Estate Optimism

Most commercial real estate indicators should return to pre-pandemic levels by 2023, the Urban Land Institute said in its latest semiannual survey.

“The U.S. economy remains relatively attractive for real estate, especially in contrast with the period immediately following the global economic downturn in 2008 and 2009,” said Ed Walter, ULI Global CEO. “While prolonged high inflation could damage the viability of pipeline projects, the short-term spike predicted should have less impact. This is why we see transaction volumes recovering so quickly and investment returns for core property types looking so healthy.”

Walter said the real estate sector is in a strong position to build its way out of the pandemic “and take the economy with it.”

The Real Estate Economic Forecast noted inflation forecasts have risen “substantially” from a 2.8 percent projection in Spring 2021 to 4.3 percent this month. “[But] the forecast is optimistic about this spike receding rapidly to near 2019 levels in 2023,” the report said.

Expected real estate returns remain fairly stable year-on-year. The new consensus is for the National Council of Real Estate Investment Fiduciaries capitalization rate to fall slightly from 4.4 percent in 2020 to 4.3 percent in 2021 and 2022 before start upward movement in 2023.

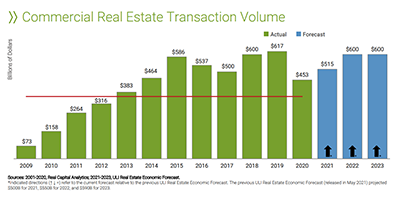

For capital markets, the report found growing optimism about commercial real estate transaction volumes in the next three years. Forecasts fell just short of 2019’s $617 billion peak. This year’s transactions could total $515 billion, followed by $600 billion in 2022 and 2023. The economists surveyed expect commercial mortgage-backed securities issuance to approach 2019’s $98 billion peak by 2023.

“Pricing and returns show a leap in expectations compared with just six months ago,” the report said.

Real Capital Analytics, New York, said its Commercial Property Price Index could increase nearly 10 percent this year, nearly double last year’s 5.3 percent growth and more than double the 4.2 percent annual consensus forecast just six months ago.