Kumar Alok Upadhyay of HCL Technologies: Redefining the Future of Lending Solutions

Kumar Alok Upadhyay is Market Lead of Digital Process Operations with HCL Technologies, Highland Ranch, Colo.

The lending solutions industry is in the midst of a new awakening. Advanced technologies such as machine learning and automation have given lenders the opportunity to improve efficiencies and overall customer experience in loan applications. Software tools, such as HCL’s EXACTO, are integrating machine learning with automation to handle and identify ill-formed and unstructured data from handwritten receipts, checks and other papers, electronic documents, images, etc. Digitally mature enterprises have adopted such tools leveraging machine learning and automation, and have shifted to SaaS-based operational models to achieve superior outcomes.

While machine learning and automation technology is helping transform operations for lenders, merely adopting a solution may not prepare the business for the future situations and its challenges. The pandemic was a major lesson that taught businesses to stay prepared for the uncertain future. So, let’s get into the minds and hearts of the lenders and borrowers, and identify which factors could help sustain the lending business in the coming decade.

Evolving expectations of consumers through generations

A recent PwC’s retail banking survey revealed that while 61% of banks considered developing a customer-centric model very important, only 17% of them were prepared for it. The fact of tomorrow is that customer experience and customer engagement will determine the success of a lender’s business. And buyers will continue to change from one generation to the other. As generations of consumers changed, their reasons for selecting a primary financial institution evolved (see Table 1 below).

Table 1: Reasons of different generations of consumers to select a new primary financial institution

| Rank | Gen Z | Millennials | Gen X | Boomers + |

| 1 | Lowest Fees 33% | Lowest Fees 28% | Best Rates 39% | Lowest Fees 33% |

| 2 | Best Rates 27% | Positive Reputation 27% | Lowest Fees 37% | Best Rates 31% |

| 3 | Positive Reputation 25% | Superior Customer Experience 24% | Cash Incentives/Rewards 24% | Cash Incentives/Rewards 31% |

| 4 | Large ATM Network 24% | Best Products 23% | Positive Reputation 22% | Convenient Branch Network 23% |

Source: BAI. The Financial Brand, Feb 3, 2021.

The table displays the focal areas of consumers of each generation. It proves that having fixed products for all consumers would be a disastrous strategy and highly unsustainable in the long term. Lenders will need to have the capability to customize their products and services for a consumer based on different factors, including their age and consumption behaviors.

Among the common factors for success are speed, customer service, and ensuring that things get right in the first time. Lenders will have guaranteed wins with these three in their arsenal. Especially since almost 80% of Gen Z are already comfortable with mobile banking. This fast-paced generation is focused on getting money quickly and expect more personalized customer engagement. For lenders, they are the future consumers. And their expectations can determine the path for future sustainability.

The reality though is that only 22% of borrowers have been reported to fully engage with the lender. Only such engaged customers are twice as likely to return to the same lender for another loan. This is all the more reason that lenders of the future must create an open customer engagement channel and prioritize transparent dealings for a longer lasting relationship.

Outcomes: Lenders for today and tomorrow

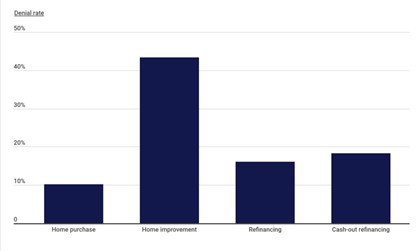

When you look closer, relationships between borrowers and lenders are built between the credit approval and closure stages. The moment borrowers receive the conditional approval, a countdown begins for the lender to complete the underwriting process and issue clear-to-close. And then, after the final approval, borrowers expect lenders to keep the end of their agreement, and accelerate the process of closing and delivering the loan amount. But, lenders cannot guarantee closure until the date finally arrives. A report suggests that denial rates vary between 10% and 43% depending on the nature of loan (See Chart 1 below).

Chart 1: Denial rates for different loan types

Source: HMDA. Construction Coverage, Jun 24, 2020

The fact is that any change in the loan application becomes ground for denial. Even after the final approval. So, to build better relationships with customers, accelerating underwriting and shortening the origination timeline would be essential. It would remove the complexities created due to the existing lengthy process.

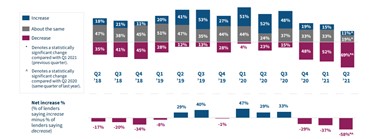

Also, lenders cannot afford to extend the timeline, owing to cost constraints. One reason is that since the pandemic began, profit margins have been tightening with each quarter (see Chart 2 below).

Chart 2: Profit margins for lenders

Source: Mortgage Lender Sentiment Survey, Fannie May. Q2 2021.

Another reason is the changing regulatory norms, which push lenders to reduce lending rates. With the already reducing profit margins, lenders will have to completely rethink their budgets to realize stakeholder value.

From fixed cost to variable cost

For controlling operational costs, lenders must move away from maintaining high cost levels of hiring people based on requirements during crucial times. This fixed cost compels the lender to pay up even in those months of no requirements. A favorable way would be to adopt variable cost-centric loan fulfillment solutions. It will provide the flexibility to pick the service according to the applications and their needs.

A future-focused lender should ensure that they have the option of scaling up or down operations depending on the applications they receive. And for this, partnering with a lending business solutions provider is the ideal move. The solutions partner not only helps lenders accelerate their origination and servicing functions, but also enhance their capabilities to better support their long term visions.

Leveraging our extensive experience and expertise in the BFSI domain, HCL has developed a holistic portfolio of products and services for lenders. HCL’s Lending Solutions offers the most advanced technologies to transform lending businesses for the future. Be it retail or commercial, HCL’s platform solutions ensure that lenders to increase their efficiencies and reduce operational cost within a few weeks.

Our global reach and deep-understanding of the financial sector of different countries have helped customers worldwide. For instance, a UK-based residential property dealing firm realized 80% reduced prices offered to lenders. And a US-based flood determination service provider reduced their cost per determination by 70%.

As we step toward an uncertain future, customers seek lending solutions that foster trust and build relationships. Having a partner that aims for the same goals can propel the business to greater heights for years, decades, and even centuries.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)