Waning Refi Volumes Spur Decline in LO Commissions

SimpleNexus, Lehi, Utah, said declining loan volumes in the third quarter pushed quarterly loan originator commission earnings by 17%.

SimpleNexus said its analysis of recently acquired LBA Ware’s CompenSafe incentive compensation management platform also found mortgage lenders increased loan processor staffing by nearly a quarter while funding fewer loans, driving average individual processor incentive compensation down by one-third.

The report said monthly commissions earned per LO in the third quarter decreased by 17% overall from a year ago. During that period, monthly refinance commissions decreased by 37%, accounting for most of the shortfall, while monthly purchase loan commissions held relatively steady, rising just 2%.

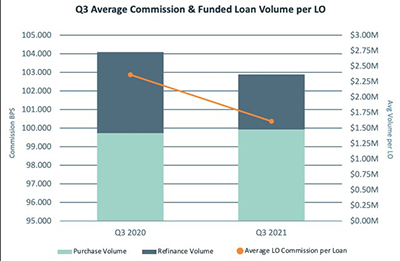

Overall, the report said LOs saw a 2.44% decrease in per-loan commission rates from 102.878 basis points in Q3 2020 to 100.372 BPS in Q3 2021. Notably, lenders dialed down per-loan commission rates on refinances by 7.17%, from 95.210 BPS in Q3 2020 to 88.384 BPS in Q3 2021. BPS paid out on purchase loans decreased 1.58% from 109.838 to 108.102.

Ther report said LOs averaged $2.2M in funded volume per month in the third quarter, a decrease of 14.9% from Q3 2020 ($2.6M). Purchase volume funded by individual LOs increased 4% from $1.4M in Q3 2020 to $1.5M Q3 2021, while refinance volume declined 32% from $1.3M to $0.9M during the same period.

LO staffing levels held relatively steady from over the past year, the report said, dipping just 2%. Simultaneously, loans funded per LO per month decreased 22%, with LOs in the sample set averaging 9.0 loans a month in Q3 2020 versus 7.0 loans a month in the third quarter.

Additionally, the report said loan processor staffing grew 23% from Q3 2020 to Q3 2021. Loan processors averaged 29% fewer loans per month in the third quarter (15.2 units) compared to Q3 2020 (21.5 units), fueling a 33% decrease in quarterly bonus compensation earned from $3,201 per processor per month in Q3 2020 to $2,140 in Q3 2021.

“The heyday of ultra-low rates and enormous refinance volume is over, and compensation is starting to settle back to pre-pandemic levels,” said Lori Brewer, SimpleNexus EVP and General Manager. “On the bright side, 2021 is still shaping up to be the second-highest production year in the last decade, with modest growth in the purchase market helping take the edge off declining refinance volumes. We will be watching to see if lenders reduce headcount or take a more conservative approach to incentive comp to protect margin.”