To the Point with Bob: Servicers are Helping Borrowers Through the Pandemic

(To the Point with Bob is a periodic blog by MBA President & CEO Bob Broeksmit, CMB. You can view this and past blogs here.)

As we approach the second anniversary of the onset of the COVID19 pandemic, mortgage loan servicers report that approximately one million homeowners are in active forbearance plans, according to MBA’s latest Forbearance and Call Volume survey. This is down from a peak of 4.3 million homeowners in June of 2020. Over the same period, MBA’s National Delinquency Survey shows a decline in mortgage delinquencies (which includes loans in forbearance) from a high of 8.22% in the second quarter of 2020 to 4.88% in the third quarter of 2021.

I share these numbers to demonstrate that the tremendous work that independent mortgage companies, banks, and credit unions have done to help borrowers stay in their homes despite the severe disruption in employment and income should not be overlooked. A reason for the success thus far has been the lessons we all learned from the last financial crisis, not the least of which is the importance of clear, honest communications between borrower and servicer.

While forbearance has always been a part of a servicer’s toolkit to help borrowers facing short-term hardships, it has never been tried on such a scale, and for such a duration, as mandated by Congress, HUD/FHA, and Fannie Mae and Freddie Mac in response to the pandemic. As with so much of the economic response to the national emergency, we are in uncharted territory.

The burden has fallen upon the servicers to implement those massive mandates, often under tight timelines and with unclear or conflicting guidance from the owners, investors, or insurers of the mortgage. At the same time, servicers themselves were dealing with the impact of the pandemic on their own offices and workforces – stay-at-home orders, quarantines, and the shift to remote work environments.

In addition to handling millions of loans in forbearance (and tens of millions of borrower contacts each month, as demonstrated by MBA’s data on borrower inquires received by servicing call centers), servicers were transitioning their workforce to work from home. And while the pandemic has created chaotic responses in our daily economic lives – think airline delays, bare shelves in markets, etc. – mortgage servicers have responded heroically to the challenge.

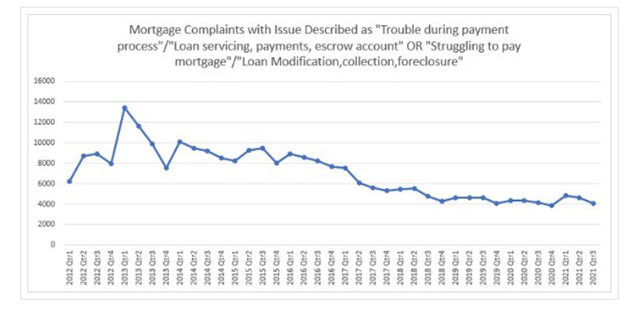

While call volumes and borrower contacts have continued to surge, the servicing industry has not experienced a commensurate increase in the number of complaints per quarter, based on the Consumer Financial Protection Bureau’s (CFPB) complaint database. In fact, complaint volume today is near its lowest level since the Bureau began reporting the data in 2012.

While the CFPB’s complaint data is not a direct proxy for servicer performance (the complaints are not verified and many represent questions or misunderstandings that are easily answered and resolved), they can serve as a directional indicator.

As I noted at the top, there remain approximately one million American homeowners in forbearance. This is not an insignificant number and one on which the industry remains intensely focused, given that many of these forbearance plans are scheduled to expire in the months ahead. Bringing these borrowers’ forbearance plans to a successful conclusion, and preventing avoidable foreclosures, will require trust and painstaking work between servicers and borrowers. Often those most at risk are the most vulnerable in our society: low to moderate-income homeowners and those in minority communities.

Policymakers have gone to great lengths to provide servicers and borrowers the tools they need to bring about a successful resolution in the vast majority of cases. I hope that policymakers will continue to allow servicers to do what they do best – help their customers. This means acknowledging the good work that servicers are doing and encouraging borrowers to work with their servicers, rather than fomenting fears of a return to the Great Financial Crisis. Both market and regulatory frameworks have changed dramatically since then, and borrowers should have confidence that their servicers’ interests and capabilities are aligned with the goal of successfully moving the customer out of forbearance into a home retention option that allows them to remain in their home for the long-term.