Initial Claims Down Another 14,000 to New Post-Pandemic Low; S&P Sees Structural Shift in Workforce

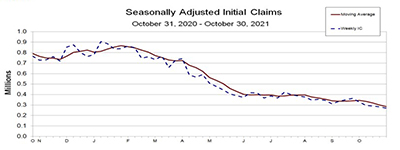

Initial claims for unemployment insurance fell by 14,000 last week and are now less than 15,000 per week away from pre-coronavirus pandemic lows, the Labor Department reported Thursday.

In a separate report, S&P Global Ratings, New York, said the reason workers aren’t filling jobs today seems to stem more from the decision to drop out of the workforce entirely, indicating a structural shift rather than a temporary change.

Labor said for the week ending October 30, the advance figure for seasonally adjusted initial claims fell to 269,000, a decrease of 14,000 from the previous week to its lowest level since March 14, 2020, when it was 256,000. The previous week’s level revised up by 2,000 from 281,000 to 283,000. The four-week moving average fell to 284,750, a decrease of 15,000 from the previous week to its lowest level since March 14, 2020, when it was 225,500. The previous week’s average revised up by 500 from 299,250 to 299,750.

The advance seasonally adjusted insured unemployment rate fell to 1.6 percent for the week ending October 23, a decrease of 0.1 percentage point from the previous week’s unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending October 23 fell to 2,105,000, a decrease of 134,000 from the previous week to its lowest level since March 14, 2020, when it was 1,770,000. The previous week’s level revised down by 4,000 from 2,243,000 to 2,239,000. The four-week moving average fell to 2,356,750, a decrease of 155,500 from the previous week to its lowest level since March 21, 2020, when it was 2,071,750. The previous week’s average revised down by 1,000 from 2,513,250 to 2,512,250.

The report said the advance number of actual initial claims under state programs, unadjusted, totaled 240,216 in the week ending October 30, a decrease of 7,114 (2.9 percent) from the previous week. The seasonal factors had expected an increase of 6,872 (2.8 percent) from the previous week. Labor reported 737,503 initial claims in the comparable week in 2020. In addition, for the week ending October 30, 35 states reported 2,195 initial claims for Pandemic Unemployment Assistance.

The report said the advance unadjusted insured unemployment rate fell to 1.4 percent during the week ending October 23, a decrease of 0.1 percentage point from the prior week. The advance unadjusted level of insured unemployment in state programs totaled 1,889,228, a decrease of 97,398 (4.9 percent) from the preceding week. The seasonal factors had expected an increase of 36,031 (1.8 percent) from the previous week. A year earlier the rate was 4.7 percent and the volume was 6,857,323.

The total number of continued weeks claimed for benefits in all programs for the week ending October 16 was 2,672,948, a decrease of 157,731 from the previous week. Labor reported 22,013,937 weekly claims filed for benefits in all programs in the comparable week in 2020.

Meanwhile, S&P said five million people in the U.S. are unemployed or have left the workforce since the pandemic began, and it is difficult to predict whether their decision was short term or permanent.

The report, “Where Are The Workers? Three Explanations Point To An Answer,” said even as extended unemployment benefits expired nationwide, and children returned to classrooms, job gains in September were meager. “Business managers complain that they can’t find employees, and the significant mismatch between job openings and labor turnover proves their point: job openings are now almost twice that of hires,” it said.

“It has been suggested that extended federal unemployment benefits offered during the pandemic have kept workers on the sidelines,” said U.S. Chief Economist Beth Ann Bovino. “This is not the case.”

The report said states that ended the extended benefits earlier than the September deadline also largely reopened their economies sooner, so the reopening effect helped these states boost employment even before those benefits ended.

According to the report, the reason workers aren’t filling jobs today seems to stem more from the decision to drop out of the workforce entirely, indicating a structural shift rather than a temporary change. Possible explanations for people’s decisions to leave the job market vary from childcare or family-care constraints, early retirement, health reasons and pandemic fears.

The report noted “swollen” savings, now about $2.5 trillion more than 2019 average household savings, give people more reason to be selective. The location mismatch was also likely a significant factor in a person’s decision to stay out of the market. Many people who moved out of cities during the pandemic have yet to return.

“The skills mismatch, which has been a problem for years, has only become worse during the pandemic,” Bovino said. “The labor market conditions since the pandemic began highlight a possible structural shift in the labor force, with 60% of the five million missing workers comprising people who have left the workforce entirely.”

On Friday, the Bureau of Labor Statistics releases its monthly Employment Situation report. MBA Chief Economist Mike Fratantoni and other economists will provide commentary and analysis in the Monday, Nov. 8 edition of MBA NewsLink.