Redfin: More Balanced Housing Market in 2022

It’s mid-November, which means it’s also time for 2022 forecasts. Redfin, Seattle, never shy, says the new year will bring more balance to the housing market. However, don’t expect a buyer’s market—just more selection, less frenzy and slower price growth.

Redfin Chief Economist Daryl Fairweather predicted a rush to buy homes at the start of the year before mortgage rates rise. That early onslaught of demand, she said, could deplete the supply of homes for sale. In the second half of the year, a much-needed increase in new construction will boost sales slightly. Redfin predicts 1% more sales in 2022 than in 2021; by the end of the year, home price growth will slow to 3%.

Other predictions for the 2022 housing market:

–Mortgage rates will rise to 3.6%, bringing price growth down to earth.

–New listings will hit a 10-year high, which will hardly make a dent in the ongoing supply shortage, passing the 2018 high of 7.6 million homes.

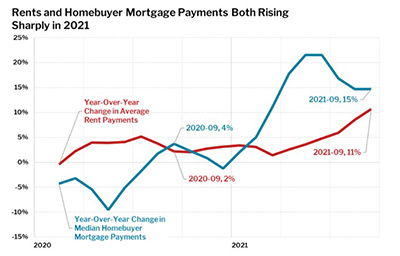

–Rents will increase by 7% by the end of 2022, more than double the predicted year-over-year growth in home prices of 3%.

–Homebuyers will relocate to affordable cities such as Columbus, Ohio, Indianapolis and Harrisburg, Pa., capital cities with highly educated residents where the median home price is still less than $250,000.

–People will vote with their feet, relocating to places that align with their politics. Now that workers have more control over where they live, more people will seek out areas where there are like-minded people with laws that fit their political beliefs.

–Condo demand will take off. Redfin said more homebuyers are open to buying a condo or townhome for a fraction of the price of a single-family home, a reversal from when the pandemic lockdowns motivated homebuyers to seek out larger homes with big backyards, which caused single family home prices to increase 27% from the start of the pandemic, while condo home prices only increased by 14%.

–Homebuyers will take climate risks seriously when choosing a home. Homebuyers will want to know about a home or neighborhood’s flood and fire risk and how that impacts their insurance costs or the mortgage rate set by their lender (a practice known as blue-lining).

–Housing policy will become central to political battles about climate change. As natural disasters due to climate change become increasingly frequent, political debates will emerge about who should pay for the damage and what the government should do to minimize future damage.

–iBuyers focus on perfecting a niche service instead of market domination. “iBuyers are going to focus their efforts on providing premium service that is truly needed for a portion of home sellers,” Fairweather said.

–The Department of Justice will crack down on how agents are paid, and it is possible that buyers will eventually have to pay upfront for their agent instead of the more common setup now where the seller pays the commission for both the buy-side and sell-side agent at closing.

The report can be found at https://www.redfin.com/news/Housing-Market-Predictions-2022/.