Spread Between Retail, Industrial Rents Compresses

Chart courtesy of JLL

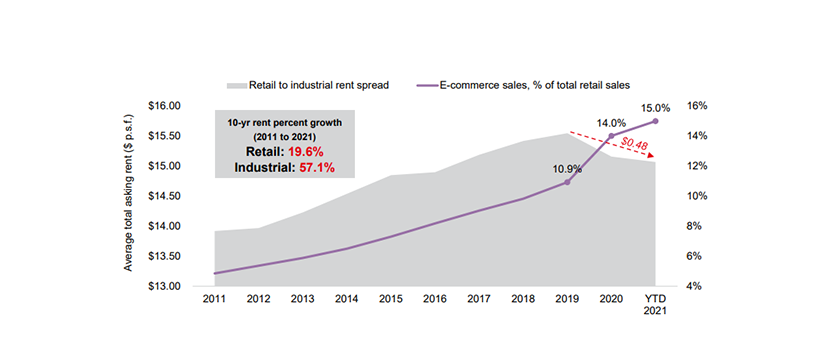

JLL, Chicago, reported the spread between retail property rents and industrial property rents is compressing as home deliveries speed up and e-commerce steals more and more market share from brick-and-mortar retailers.

“As e-commerce gains share of retail sales, industrial space is becoming more demanded and pushing rents,” JLL said in its U.S. Industrial Snapshot report.

JLL said the need for e-commerce distribution space is pushing retail and industrial rents closer together as delivery from fulfillment centers to consumers grows ever faster. “2019 saw the beginning of the rent compression, which coincides with a big jump in e-commerce’s share of retail sales,” the report said.

Industrial rents grew by nearly forty percentage points more than retail rents over the past ten years, JLL said. “We expect this trend to continue as more and more new industrial space hits the market and is leased up and as the low vacancy rates continue to set the stage for a competitive leasing environment. Both of these factors–the newer supply and leasing competition–contribute to a rise in industrial rents.”

Colliers International Research Director for U.S. Capital Markets Aaron Jodka said e-commerce growth is projected to top $1 trillion next year. “This means that occupiers, like Amazon, will need more space to meet the demand of consumers shopping from home,” he said in Colliers’ Industrial Update report.

But e-commerce “is just part of the story,” Jodka said. “Manufacturing production is still growing faster than expected.” Growth in manufacturing production will combine with e-commerce growth to boost industrial space demand, he said, noting development is picking up to meet these needs.

“Overall, strong economic readings point to sustained growth in industrial real estate,” Jodka said. “Gains in e-commerce and brick-and-mortar sales should fuel the sector in the months to come and translate demand for industrial space into new leasing and ongoing robust construction. Low vacancy in many industrial markets will guarantee growth in new builds to meet occupiers’ industrial space needs.”