Murali Tirupati: How Intelligent Automation Can Simplify Mortgage Origination, Boarding and Servicing

Murali Tirupati is a serial entrepreneur and cofounder & CEO of mortgage automation startup, Vaultedge, which helps mortgage lenders, servicers and investors automate document processing to reduce loan production, boarding and due diligence costs. He has 20 years of enterprise software consulting and sales experience. He has an MBA from Indian Institute of Management, Ahmedabad and a BS in Electronics & Communications Engineering from NIT, Trichy.

The U.S. housing market is one of the most vibrant among the developed economies with more than $10.3 trillion in mortgage debt. Even as more than 6 million home sales happen every year, the U.S. market is witnessing tough competition among lenders to capture new customers. As deposits are consolidating among top banks, the mortgage market is going through further fragmentation in an industry with an accelerated pace of change. The legacy platforms seem to be holding traditional lenders back while new-age institutions are grabbing a share of the pie in the mortgage market faster than ever.

Disruption at gate

With the proliferation of advanced technologies, business processes are being streamlined with the help of new-age technologies that have put many banks at an disadvantage over their peers. With more demanding and tech-savvy borrowers, nonbank lenders are eating up the pie by offering more nimble solutions. Between 2010 and 2016, the share of the top 5 banks in loan origination came down from $999 billion to $515 billion while that of top nonbanks grew from $128 billion to $656 billion.

There are no easy answers to be found for legacy banks and those looking to grow their presence in the broader mortgage market, but the clue perhaps lies in the friction involved in existing mortgage processes. Mortgage origination remains largely a people-intensive business and its people are proving to be more and more expensive and as a result mortgage origination costs also are going up. As the number of available data points continues to rise, so does the cost of people who collect, classify, index, verify and investigate those crucial factors which determine the lending decision.

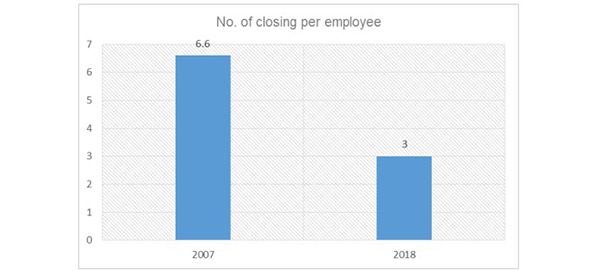

More than 21% of people related costs for lenders go towards production and fulfillment personnel even as closings per employee reduced from 6.6 to 3.0 between 2007 and 2018 During the same period, the cost of a loan production rose from $3500 to $8278 (as per MBA.org historical overview statistics)

Perils of manual process

While the cost of mortgages continues to climb, the closing time isn’t reducing. The national average closing time is about 44 days for purchase loans while it’s closer to 45 days for refinancing. However, in lived experience, the closing time can be as high as eight weeks as well.

Here’s a lowdown of what exactly a mortgage application process entails. After submitting her employment details, financial statements and credit history for prequalification, a borrower enters the application process where she is required to submit a plethora of documentation consisting of their rental payments history, bank account statements, tax returns, proof of income such as pay stubs or W-2s and gift letters, apart from the signed sales agreement and gift letter if they are utilizing gift funds. These documents are then appraised by the mortgage lender that could come back and ask for additional supporting information.

Loan appraisal officers must check all these documents running into several hundred pages for accuracy, completeness, and validity of the data points. In most cases, this process of document indexing, data extraction and bookmarking takes weeks and puts a barrier on the ability of banks to service a large number of mortgages concurrently and limits their potential for securitization/repurchase transactions.

This process moves on to the next step only when all documentation has been gathered, data-points collected and verified and fed into the banks’ loan management system which qualifies the borrowing.

Since the process of collecting thousands of data points is people-intensive, the probability of biases, errors, and omissions is high and difficult to control which could further put a strain on the bank’s processes and efficiency. Mortgage industry is ripe for disruption through advanced technology which can help lenders reduce loan file defects greatly. About 2% of mortgages were found to have at least one critical defect. A critical defect is one that would result in the mortgage being uninsurable or ineligible for sale. About 20% of the discovered critical defects in loan files were found to be loan package and regulatory defects.

If sustained across mortgages, these defects are likely to elevate repurchase risk levels and put the portfolio at risk. This is the reason why manual processing of mortgages is costly and complex, for both banks and customers.

Solving mortgage through advanced tech

The problem is that data input by the loan officer must be signed off by the underwriter but there’s no easy way for humans to judge the veracity of hundreds of complex pages of information in a short time and to do it repeatedly. Moreover, simple errors of omission such as expiry certificates on credit declaration, etc. are hard to detect.

This problem magnifies on downstream transfer of the file when this data has to be put into the servicing system which may have different reporting standards than the structure of the original file leading to hours being spent on mapping, testing and reconciliation between the two, just to ensure that correct data is making it to the required fields.

While click and upload capabilities for documents in most loan origination processes have limited the headache for customers to provide hard copies for all their documents. It has further complicated the process for the mortgage lender.

Since the data is captured through various devices such as phones and scanners, the files are of different sizes and resolutions. Now, there are different formats of files to be dealt with from scanned PDFs to excel sheets, as well as some necessary hard copies such as photo IDs. Processing these into one large single-PDF binary large object file (BLOB) takes time and data is often lost/misrepresented in the manual conversion process. With the advances in machine learning techniques and applications such as visual document classification, character recognition, automated classification and adaptive learning processes which get better over time in performing repetitive tasks, lenders will be able to leverage technology to improve the origination processes. Some of the major capabilities provided by Artificial Intelligence (AI) powered software include:

- Document recognition

Mortgage onboarding software are able to classify documents by type and reduce the work for loan personnel.

2. Document Validation

Software can automatically highlight missing documents. The software keeps track of document requirements for different mortgage types, federal/state requirements and automatically alerts users of missing documents. The process flags missing documents which are mandatory specific to the laws laid down by the government, state or the county.

3. Data Extraction

The capabilities for data extraction allow data to be collected from the mortgage file with both structured and unstructured documents.

4. Data Validation

With advanced intelligence, data can be read by the computer and validated on the spot. For instance, it’s possible for the system to now raise flags if the bank statement is more than a month old or if the borrower name is not matching across all documents.

5. Verification

Intelligent loan-boarding processes allow the user to verify that data extracted from a mortgage file is accurate. Inferior image quality can sometimes lead to incorrect data extraction. With advanced software, such possible errors are highlighted to users well in advance and allow them to go to the source and correct these errors.

6. Integration into Loan Origination Systems (LOS)

Documents that are classified and data that has been extracted and verified can be imported into LOS through seamless integration provided by such tools. Advanced technology solutions are also able to bookmark the data at a document type and data field level to allow the reviewer to go directly to any data field to verify the extracted data. While many lenders currently use optical character recognition technology (OCR) to extract data from the mortgage documents file, modern AI-based software have proven to be far superior.

The legacy OCR problem has always been its incompetence when dealing with unstructured data or documents. Further, OCR tends to read what it can see and bad image quality can seriously derail the data extraction processes.

However, modern AI-based technology improves its manifold by deploying intelligent capabilities to spot errors, flag bad image quality and at the same time, use machine learning and natural language processing to ensure that loan processing is not only fast but accurate as well.

These solutions allow the mortgage lenders to heavily speed up the process while maintaining consistency and accuracy throughout the loan origination lifecycle. Thus, a mortgage lender is now technically capable of ingesting more than 10,000 mortgages in a single day.

Making Mortgage Smarter

While conventional lending is fast moving towards a technology-backed process for verification and analysis of loan package files, there’s a lot more that needs to be done. The problem is multi-fold since many lenders seem to still believe that innovation in advanced technology must happen in house which tends to prove more expensive and provides a slower glide path towards more efficient processes. However, the successful ones deploy in-house capabilities to keep an eye on the process while also using niche-technology providers to piece together a solution that is more reliable and cost-effective.

It’s clear that lenders are being challenged on several fronts and to protect their turf, a rapid change in their technology stacks is on the cards. Technology, after all, is being viewed by mortgage institutions as one of the top priorities in increasing their overall competitiveness.

Utilizing intelligent automation in the loan origination process gives the institution the following advantages:

- Fewer Errors

A quality loan-origination system backed by a strong technology stack is not just limited to optical character recognition for reading the data through the files. It’s capable of cleaning, indexing and analyzing the data to point out inconsistencies and reduce fraud and risk. The reduction of human intervention in this process reduces the probability of errors in the transaction allowing for faster, better-quality evaluation decisions.

2. Reduced Time to Close

The national average for mortgage closing is around 45 days which is an exceptionally long time for customers to wait for a decision. This time also increases if the documentation is found to be inconsistent or incomplete and the customers get to know only towards the end of their loan appraisal. AI-based loan file package extractors and indexing solutions allow lenders to process a lot more loan applications daily without having to invest in additional human resources.

3. Risk Management

With paper-based loan underwriting processes, the visibility is limited on the portfolio’s exposure and its volatility over time. Without proper reporting tools which monitor the health of incoming and outgoing loans, it’s difficult for a mortgage institution to make a credit decision that is in line with its stated risk tolerances. Automation of the loan origination process ensures that there are robust controls for risk in the portfolio.

4. Improved Loan Book

Be it reducing underperforming loans from the credit pie or increasing the total size of the loan book, it is impossible to overemphasize the importance of automating key steps of the mortgage origination process. The automation gives more time to the analyst to perform their risk assessment which may include judging the ability and willingness of the borrower to repay the loan through financial modeling and automated risk rating.It reduces the critical defect rate in mortgages improving the quality of data with the lenders.

5. Easier Compliance

Mortgage institutions rate regulatory risk very high in their table of priorities when it comes to assessing and ingesting transactions. The recent TILA/RESPA Integrated Disclosure Rule (TRID) increased the cycle time to above 50 days because lenders found it tough to comply with the new reporting standards. The cycle time has come down to around 45 days now, but new regulations are always challenging for even the biggest institutions and automating processes is the only way to configure technology to ensure that regulatory needs are fulfilled well in time.

Conclusion

Loan origination and servicing doesn’t have to be a tiresome process. Advances in technology can vastly improve the process and experience for all parties in the transaction – only if legacy platforms make way for their new-age counterparts. Many mortgage originators are considering changing their loan origination systems (LOS) to reduce costs and improve the agility of their processes to keep up with evolving client expectations and competitiveness in the industry. Mortgages will continue to be disrupted through LOS replacements but for the industry, a rethink on the customer experience is long overdue.

New-age solutions are best suited outside the traditional guilds of legacy platforms, where a buy and build model along with modular IT architecture allows institutions more visibility, better returns on investments and reduces the overall onboarding and transaction risk. The crucial bit here is to test and learn by employing agile methodologies. This requires skill in both product and technology but till the time capacity-building efforts allow lenders to do it in-house, they are better off using specialized solutions from tech innovators that can propel them into a new epoch instantly.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)