BREAKING NEWS

MBA: Loans in Forbearance Fall to Pandemic-Era Low

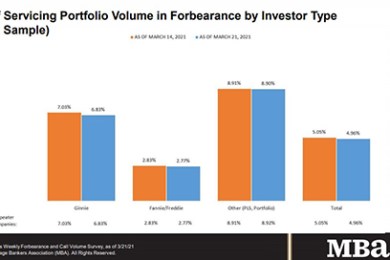

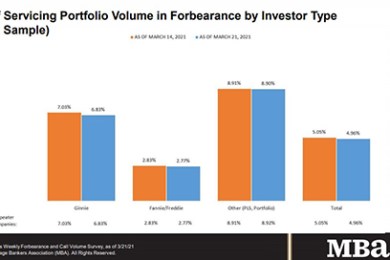

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 9 basis points to 4.96% of servicers’ portfolio volume as of March 21 from 5.05% the week before. This marks the fourth consecutive week of decreases. MBA estimates 2.5 million homeowners are in forbearance plans.

The Centers for Disease Control and Prevention announced yesterday an extension to the eviction moratorium further preventing the eviction of tenants who are unable to make rental payments. The moratorium that was scheduled to expire on March 31 is now extended through June 30.

CBRE, Dallas, said commercial real estate investors are showing a clear shift in risk tolerance--and a new preference for secondary markets.

![]()

Embrace Home Loans, Lehi, Utah, announced plans to roll out SimpleNexus, a homeownership platform for loan officers, borrowers, real estate agents and settlement agents, to more than 300 retail mortgage LOs before the end of the year.

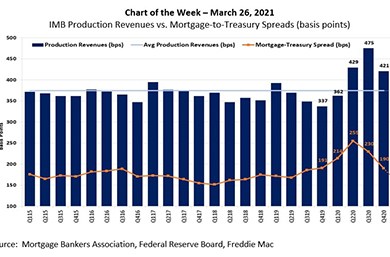

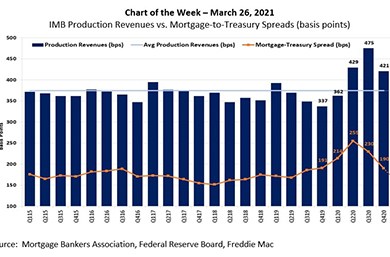

In this Chart of the Week, we compare in basis points the average quarterly credit spreads between the 30‐year mortgage rate (as surveyed by Freddie Mac) and the 10‐year Treasury yield to production revenues (fee income, secondary marketing income and warehouse spread).

Bellwether Enterprise Real Estate Capital LLC, Cleveland, closed a $59 million Fannie Mae Multifamily Affordable Housing loan deal to acquire Broadstone 8 One Hundred, located at 8100 Anderson Mill Road in Austin, Texas.

Jerry Schiano is CEO of Spring EQ, Philadelphia, a nationwide refinance, home equity and HELOC lender.

The Mortgage Bankers Association's young professional’s group, mPact, welcomes a new chair this month for the Commercial Production Advisory Council, Berkadia’s Maggie Burke.

Auction.com, Irvine, Calif., promoted Ali Haralson to president, a new position in the company that will oversee both sales and operations.

MISMO, the industry’s standards organization, developed iLAD through close collaboration across the industry, including with lenders, vendors, IT companies and GSEs. The MISMO Loan Application Data Exchange (LADE) Development Work Group is working to ensure these iLAD specifications will continue to evolve to meet industry needs.

While there is a tremendous benefit to adding Ginnie Mae specified (spec) pools as part of a diversified execution strategy, lenders cannot continue to operate as if it’s business as usual when faced with the current volatility in the mortgage-backed securities market. Instead, speed must become of the essence, and lenders need to move as quickly as possible while monitoring the MBS market closely to continue effectively utilizing this strategy and maximize their secondary profitability.

Community banks need to focus on partnerships with fintechs to deliver exceptional experiences and solve some of their most fragmented challenges. Fragmentation is expensive and riddled with risk and inefficiencies—and the lending and banking industries are full of fragmentation.

Bridge lending remains an active piece of the commercial real estate finance pie heading into the anticipated economic recovery in the second half of 2021. These products and the large number of institutions offering them to sponsors are defining features of an economy in transition.