Reports Cite Progress—and Work to Do—for Female/Minority Home Buyers

Two reports illustrate both the progress made in lending to women and minorities and the challenges lenders continue to face in expanding minority homeownership.

Redfin, Seattle, reported despite the coronavirus-driven recession disproportionately affecting women in 2020, single women purchased 8.7% more homes in the fourth quarter than a year earlier. That’s a larger increase than single men, who purchased 4.6% more homes in the fourth quarter than a year earlier. Couples bought 11.5% more homes than a year earlier.

However, in a separate report, Zillow, Seattle, said nearly 15 percent of Black and Hispanic/Latino Americans remain “credit invisible” and largely cut off from homeownership. Zillow said expanding access to credit could shrink the homeownership race gap.

Redfin reported single women made up 15.7% of total home purchases nationwide in the fourth quarter, compared with 15.3% a year earlier. The share has remained stable between 14.8% and 16.1% since 2012. This is even as the pandemic-driven recession forced women out of the workforce at a greater rate than men, especially women of color. Even before the pandemic, women earned just 82 cents for every dollar earned by men. The recession hit women-dominated industries—including restaurants, retail and healthcare—hardest, and many women have chosen to leave paying jobs to take care of children.

“This is another illustration of America’s uneven financial recovery,” said Redfin chief economist Daryl Fairweather. “While millions of women have lost their jobs during this recession, the impact has largely been on lower-income women. Meanwhile, most women who were able to afford homes before the pandemic are likely still able to afford homes, and low mortgage rates—especially at the end of 2020—have been incentivizing them to buy.”

The report said single men made up 18.1% of home purchases in the fourth quarter, essentially flat from 18.3% a year earlier. The share of home purchases by single men also hasn’t varied much over the past eight years, spanning from 17.8% to 20.1%. Couples—two (or more) people buying a home together—made up 49.4% of purchases in the fourth quarter, up slightly from 46.9% the year before. The remainder of home purchases were either made by institutions or they fall into the “other” category.

Redfin noted women tend to buy less expensive homes than men. The typical home purchased by single women in the fourth quarter sold for $294,000, up 15% year over year. That’s compared with $310,000 for single men, up 17% year over year, and $430,000 for couples, up 15%. The median monthly mortgage payment for single women was $1,052 in the fourth quarter, compared with $1,125 for single men and $1,535 for couples.

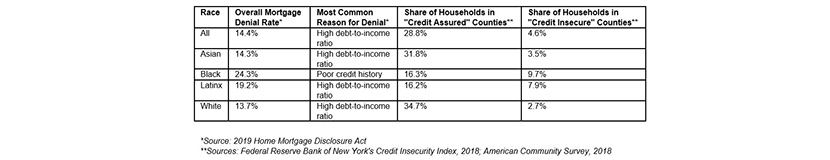

Meanwhile, Zillow said nearly 15 percent of Black and Hispanic/Latino Americans remain “credit invisible” and largely cut off from homeownership. Its report said limited access to credit-building products and services disproportionately cuts off Black and Latinx Americans from the wealth-building advantages of homeownership that can last for generations.

Zillow said 26 million Americans do not have a credit record and 12.5 million adults live in “credit insecure” counties, characterized by a high number of residents with poor or no credit history, as well as relatively limited structural access to formal credit products and services. A disproportionate number are Black or Latinx.

Nicole Bachaud, economic data analyst with Zillow, said one of the many consequences of restricted credit access is the inability to secure homeownership — nearly three-quarters of home buyers (72%) obtain a loan to help pay for their home, and an even higher rate of Black (78%) and Latinx (77%) home buyers do. As counties become more credit secure there is a direct and meaningful correlation with higher homeownership rates, outlining a possible path to bridging the racial homeownership gap. Potential drivers could include adjusting the way credit history is recorded and expanding the reach of small lenders that are less likely to deny applicants based on their credit history.

“Lower homeownership is just one of many negative results borne out of poor credit health in communities nationwide,” Bachaud said. “For many, walking into a bank or going online to apply for a loan or open a new credit card is simple. But for those excluded from the formal credit market in this country, it is a far more daunting task, and Black and Latinx households are especially vulnerable. A shift in credit reporting might be a first step to reducing the systemic barriers into homeownership and the financial market overall.”

Zillow said credit history, or lack thereof, is the number one reason mortgage applications are denied to Black applicants, underscoring the potential for progress in this area. “Being credit invisible can create a catch 22 that’s difficult to break out of — opening new lines of credit is often conditional on having an existing credit score — and can bleed into future generations, as lack of access to credit now will limit future wealth accumulation and the amount of generational wealth available to pass on,” the report said.