Home Equity Continues to Soar: Homeowners Gained $1.5 Trillion in 2020

CoreLogic, Irvine, Calif., said U.S. homeowners with mortgages saw their equity increase by 16.2% year over year, representing a collective equity gain of more than $1.5 trillion, and an average gain of $26,300 per homeowner, from a year ago.

The company’s fourth quarter Home Equity Report noted as competition for the dwindling supply of for-sale homes drove prices up, average annual homeowner equity gains in the fourth quarter reached the highest level since 2013.

CoreLogic Chief Economist Frank Nothaft said for current owners, these gains have created a buffer against financial difficulties brought on by the pandemic, and enabled means for pursuing renovations as people are spending more time at home. For the broader market, home equity gains have also reduced the risk of homes falling underwater and pushing distressed sales into the market.

“Compared with a year earlier, home prices in December 2020 were up sharply — 9.2%, according to the CoreLogic Home Price Index — boosting the amount of home equity for the average homeowner with a mortgage to more than $200,000,” Nothaft said. “This equity growth has enabled many families to finance home remodeling, such as adding an office or study, further contributing to last year’s record level in home improvement spending.”

“Positive factors like record-low interest rates and a booming housing market encouraged many families to enter homeownership,” said Frank Martell, president and CEO of CoreLogic. “This growing bank of personal wealth that homeownership affords was noticed by many but in particular for first-time buyers who want a piece of the cake. As a result, we may see more of those currently renting start to enter the market in the near future.”

The report said from the third quarter to the fourth quarter, mortgaged homes in negative equity decreased by 8% to 1.5 million homes or 2.8% of all mortgaged properties. On an annual basis, 1.9 million homes, or 3.6% of all mortgaged properties, were in negative equity a year ago; this number decreased by 21%, or 410,000 properties, in the fourth quarter.

CoreLogic said the national aggregate value of negative equity was approximately $280.2 billion at the end of the fourth quarter, down by $3.4 billion, or 1.2%, from $283.6 billion in the third quarter and by $7.5 billion, or 2.6%, from $287.7 billion a year ago.

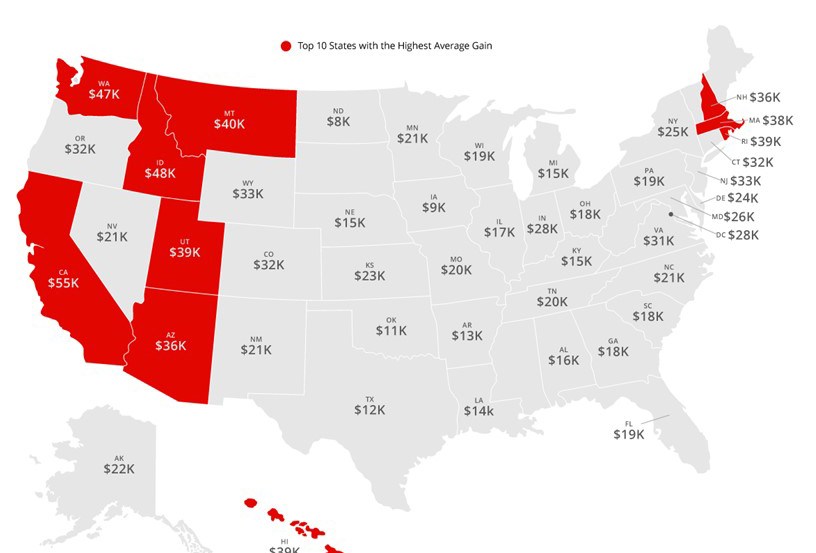

States with strong home price growth and high home prices continued to experience the largest gains in equity, whereas states that were hard hit by the pandemic continue to experience dwindling gains. California, Idaho and Washington experienced the largest average equity gains at $54,500, $48,500 and $47,200, respectively. North Dakota experienced the lowest average equity gain in the fourth quarter at $7,900.