Unemployment Insurance Claims Rise, But Trend Lower

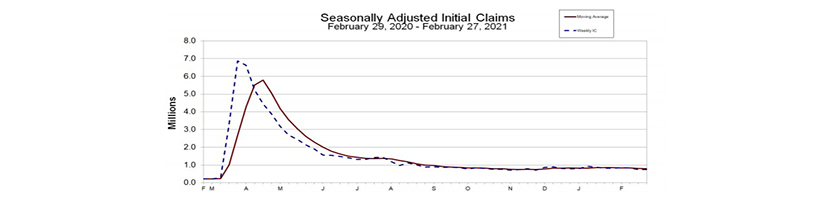

Initial claims for unemployment insurance rose for the sixth time in the past seven weeks, the Labor Department reported yesterday, but overall claims continued to trend lower with spring approaching.

For the week ending Feb. 27, the advance figure for seasonally adjusted initial claims rose to 745,000, an increase of 9,000 from the previous week’s revised level, which rose by 6,000 to 736,000. The four-week moving average, however, fell to 790,750, a decrease of 16,750 from the previous week’s revised average.

The advance seasonally adjusted insured unemployment rate fell to 3.0 percent for the week ending February 20, a decrease of 0.1 percentage point from the previous week’s unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending February 20 fell to 4,295,000, a decrease of 124,000 from the previous week’s unrevised level of 4,419,000. The four-week moving average fell to 4,448,000, a decrease of 99,000 from the previous week’s unrevised average of 4,547,000.

The report said the advance number of actual initial claims under state programs, unadjusted, totaled 748,078 in the week ending February 27, an increase of 31,519 (or 4.4 percent) from the previous week. Seasonal factors had expected an increase of 22,358 (or 3.1 percent) from the previous week. Labor reported 216,982 initial claims in the comparable week in 2020. In addition, for the week ending February 27, 53 states reported 436,696 initial claims for Pandemic Unemployment Assistance.

The report said the advance unadjusted insured unemployment rate was unchanged at 3.4 percent during the week ending February 20. The advance unadjusted level of insured unemployment in state programs totaled 4,806,269, a decrease of 22,355 (or -0.5 percent) from the preceding week. Seasonal factors had expected an increase of 101,951 (or 2.1 percent) from the previous week. A year earlier the rate was 1.4 percent and the volume was 2,105,457.

The total number of continued weeks claimed for benefits in all programs for the week ending February 13 fell to 18,026,537, a decrease of 1,018,763 from the previous week. Labor reported 2,092,483 weekly claims filed for benefits in all programs in the comparable week in 2020.

Sarah House, Senior Economist with Wells Fargo Securities, Charlotte, N.C., said the gain in claims reflects some catch-up in filings after mid-month storms and noted after going nowhere the first six weeks of the year, the trend in claims is heading lower. “Claims along with other data suggest [Friday’s] payrolls report will show a pickup in job growth,” she said.

House said while the President’s Day holiday has also interjected some noise to recent weeks’ figures, the four-week average dropped to the lowest level since early December. “In short, initial jobless claims are finally indicating that the jobs picture is beginning to firm up again after a rough winter,” she said. “Other data suggest the jobs recovery has regained its footing…With vaccinations hitting their stride and substantial fiscal support making its way through the economy, growing optimism around growth should help shift the jobs recovery into higher gear in the next few months. We look for payrolls to have increased by 210K in February, but expect a marked pickup in the spring and summer.”