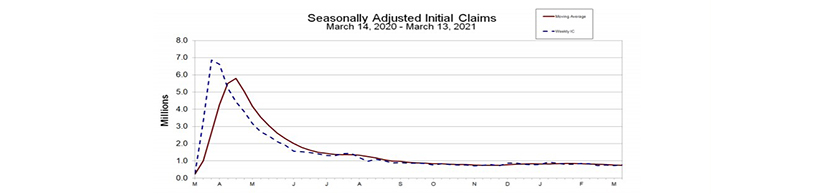

Initial Claims Rise; Trend Remains Positive

Initial claims for unemployment insurance rose last week, the Labor Department reported Thursday, but analysts said overall trends stayed positive as economic activity picked up steam.

The report said for the week ending March 13, the advance figure for seasonally adjusted initial claims rose to 770,000, an increase of 45,000 from the previous week’s revised level, which increased by 13,000 from 712,000 to 725,000. The four-week moving average fell to 746,250, a decrease of 16,000 from the previous week’s revised average.

The advance seasonally adjusted insured unemployment rate ticked up to 3 percent for the week ending March 6, an increase of 0.1 percentage point from the previous week’s unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending March 6 fell to 4,124,000, a decrease of 18,000 from the previous week’s revised level, which fell 2,000 from 4,144,000 to 4,142,000. The four-week moving average fell to 4,255,500, a decrease of 99,000 from the previous week’s revised average.

Labor said the advance number of actual initial claims under state programs, unadjusted, totaled 746,496 in the week ending March 13, an increase of 24,318 (or 3.4 percent) from the previous week. The seasonal factors had expected a decrease of 20,961 (or -2.9 percent) from the previous week. The report noted 251,416 initial claims in the comparable week in 2020. In addition, for the week ending March 13, 53 states reported 282,394 initial claims for Pandemic Unemployment Assistance.

The report said the advance unadjusted insured unemployment rate was unchanged at 3.2 percent during the week ending March 6. The advance unadjusted level of insured unemployment in state programs totaled 4,486,389, a decrease of 95,541 (or -2.1 percent) from the preceding week. The seasonal factors had expected a decrease of 77,947 (or -1.7

percent) from the previous week. A year earlier the rate was 1.4 percent and the volume was 1,977,272.

The total number of continued weeks claimed for benefits in all programs for the week ending February 27 fell to 18,216,463, a decrease of 1,902,005 from the previous week. Labor reported 2,087,219 weekly claims filed for benefits in all programs in the comparable week in 2020.

The labor market’s recovery continues in fits and starts, with initial jobless claims rising to 770K last week, but the four-week average is moving lower,” said Sara House, Senior Economist with Wells Fargo Securities, Charlotte, N.C. “Strengthening activity—on full display with a blockbuster Philly Fed reading of 51.8 [Thursday]—should lead to a marked improvement in labor conditions in the next few months.”

House noted while claims rose, the trend remains downward. “With more fiscal support starting to hit household bank accounts this week, rising vaccination rates and milder weather, strengthening activity should drive claims lower,” she said. “That said, the rapidly changing economic environment will keep businesses in adjustment-mode and claims elevated for a while.”