Hotel Profitability Improves Slightly

U.S. hotel gross operating profit per available room improved slightly from prior months in January, but remains in the low single digits, reported STR, Hendersonville, Tenn.

The hotel sector saw gross operating profit per available room fall 95.9 percent year-over-year to just over $3 in January. Total revenue per available room fell 73.3 percent to $60.94. The good news is the $3.14 gross operating profit per available room represented the highest figure seen since October 2020, STR said.

“As we approach the one-year mark of the first major restrictions in the U.S., profitability is at least sitting on the positive side of the spectrum,” said STR Assistant Director of Financial Performance Raquel Ortiz. “Year-over-year percentages are soon going to look a lot nicer thanks to comparisons with the low months of last year, but hoteliers are not going to feel a sense of security until profitability rises to meaningful absolute levels.”

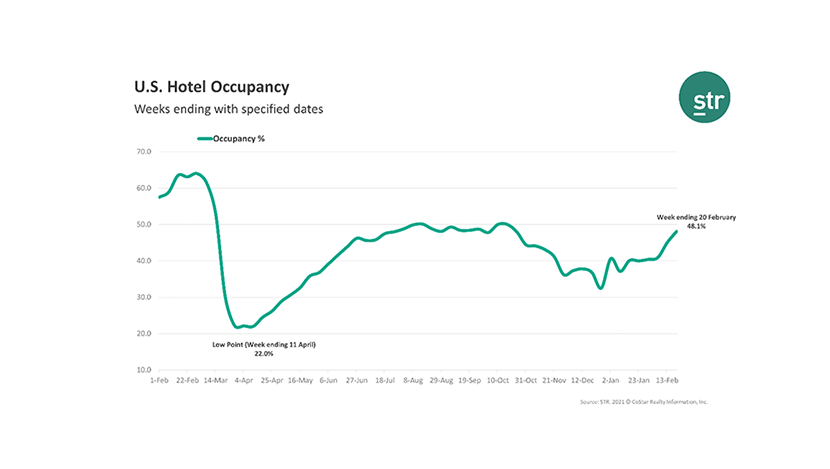

Ortiz noted some improvement in other top-line metrics in recent weeks and said hotel operators are optimistic metrics will continue to improve as long as pandemic metrics improve and vaccine distribution expands. “In the meantime, hoteliers are adapting and displaying profit efficiencies like ‘grab and go’ food and beverages and less frequent room cleaning,” she said. “We expect those types of efficiencies to carry over when recovery kicks into a higher gear, adding to substantial improvement in profit margins.”

Elaine Sahlins, Executive Director of Cushman and Wakefield’s Valuation & Advisory Hospitality and Gaming Group, said hotel sector optimism increased as vaccines began to roll out, but noted a distinct lack of certainty about the future.

“Despite overall optimism for a recovery, uncertainty remains,” Sahlins said in Cushman’s U.S. Lodging Industry Overview. “New strains of COVID-19, the long-term effectiveness of the vaccines, the ability to vaccinate enough people and the economic and personal safety confidence may derail expectations at any time. Industry pundits talk about an ‘uneven’ recovery and that is likely to be true based on the location, property type, operator approach and available capital for any particular hotel.”

Sahlins said similar to recent hotel sector recoveries, occupancy will likely return first, followed by hotel room rate recovery. “But both measures will require time and patience as we navigate this pandemic’s challenges,” she said. “Nevertheless, long-term expectations remain positive for the hotel industry to bounce forward rather than bounce back–as can be evidenced by the adoption of leaner operating models and the significant amount of capital sitting on the sidelines.”