February Sees Strong 379K Job Gain

Employers added an impressive 379,000 jobs last month, the Bureau of Labor Statistics reported Friday, welcome news for an economy still struggling with the loss of millions of jobs resulting from the coronavirus pandemic.

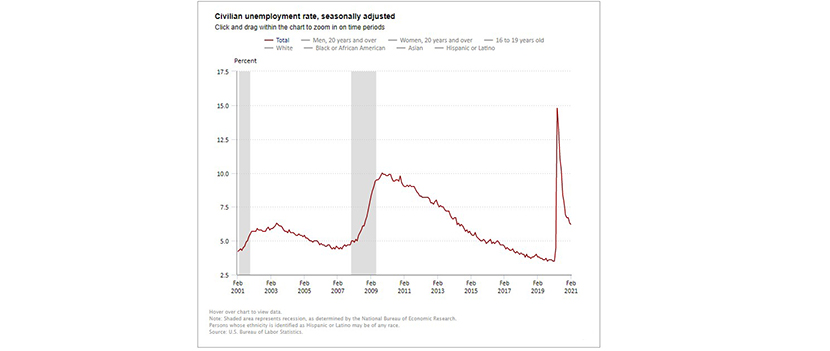

BLS reported the unemployment rate fell by one-tenth of a percentage point in February, to 6.2 percent from 6.3 percent. The number of unemployed people remained relatively unchanged at 10 million. Both measures remain well above their pre-pandemic levels (3.5 percent and 5.7 million, respectively.

BLS revised down the change in total nonfarm payroll employment for December by 79,000, from -227,000 to -306,000, and revised upward January numbers by 117,000, from +49,000 to +166,000. With these revisions, employment in December and January combined was 38,000 higher than previously reported.

The report said the labor force participation rate remained at 61.4 percent in February. This measure is 1.9 percentage points lower than the value a year earlier. The employment-population ratio, at 57.6 percent, changed little over the month but is down by 3.5 percentage points over the year.

“Job growth picked up sharply in February – welcoming news for the economy in early 2021,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Associatoin. “The 379,000 gain was led by a 465,000 increase in private sector jobs, but employment is still down 6.2% compared to February 2020, and offsetting these gains were losses in government education jobs (-69,000). The bulk of the job growth (355,000) was in the hard-hit leisure and hospitality sector, which is still down 20.4 percent compared to last year. Similar to last month, temp hiring increased, and there were also widespread gains in the retail trade sector. With January’s growth revised up by 117,000, the jobs picture is brighter than expected.”

Fratantoni noted despite last month’s drop in the unemployment rate, 10 million people are still unemployed, with 4.1 million among the long-term unemployed – up 125,000 from January. “A potential positive sign for increased downtown activity and hiring in the coming months is the fact that the number of workers returning to the office increased in February – 22.7% teleworked due to pandemic vs. 23.2% in January,” he said. “All in, this report is strongly positive for the broader economy’s growth prospects over the next several months. We have been expecting a burst of activity from pent-up demand as the vaccine rollout continues. This may be the first sign of that increase. Higher employment will support a very strong spring housing market, while somewhat higher mortgage rates will continue to slow refinance activity.”

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., said widespread distribution of coronavirus vaccines could further boost the labor market in the months to come.

“The economy has only regained approximately 58% of the jobs lost at the start of the pandemic, but the recovery has momentum now,” Kushi said. “Successful vaccine dissemination may help the hardest hit sectors recover, providing a boost to the labor market, with faster growth skewed to the services sector.”

Kushi noted employment in residential construction continued its 10-month rising trend – now 2.2% above a year ago. “Good news for an industry in desperate need of more supply,” she said. “The construction industry remains a labor-intensive industry – you need more construction workers to build more homes.”

Sarah House, Senior Economist with Wells Fargo Securities, said the report gives some of the strongest evidence yet that the labor market recovery is back on track after stalling earlier this winter. “Hiring was widespread across industries and the unemployment rate ticked down for the right reasons,” she said. “Although there is still a long way to go in terms of a full recovery, things appear to be once-again moving in the right direction.”

House added as COVID is brought under control and the economy more fully re-opens this summer, “participation among women (and men) will rebound strongly, but some individuals won’t easily find their way back to the labor force, which will keep the Fed biased toward staying accommodative for longer even as inflation risks mount.”

Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C., said job gains in leisure and hospitality are a “strong signal” of the service sector reopening. “As this sector is heavily dependent on people gathering in close proximity, we believe the efficient distribution of effective COVID-19 vaccines will be crucial to support the ongoing recovery,” he said.

BLS said average hourly earnings for all employees on private nonfarm payrolls increased by 7 cents to $30.01. Average hourly earnings for private-sector production and nonsupervisory employees, at $25.19, changed little (+4 cents). The large employment fluctuations over the past year—especially in industries with lower-paid workers—complicate the analysis of recent trends in average hourly earnings.

The report said the average workweek for all employees on private nonfarm payrolls declined by 0.3 hour to 34.6 hours in February. In manufacturing, the workweek declined by 0.2 hour to 40.2 hours, and overtime declined by 0.1 hour to 3.1 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls declined by 0.4 hour to 34.0 hours.