Trepp: ‘Mixed Results’ for CRE Bank Loan Performance

Trepp, New York, reported “mixed results” for bank commercial real estate loan performance in the first quarter.

“Even as delinquency rates begin to decline, occupancy and origination data is still cloudy,” said Maximillian Nelson, Research Analyst with Trepp.

The firm analyzed nearly $80 billion in bank CRE loans. It said the rising delinquency rates seen in 2020 are starting to cure “in a positive direction.” The overall bank CRE loan delinquency rate equaled 1.15 percent in the first quarter, down from 1.28 percent in the previous quarter. Trepp said 0.9 percent of loans are non-current, a 4 basis point decline from the previous quarter but above first- through third-quarter 2020 levels.

Nelson credited widespread vaccine adoption, the Fed’s easy-money policy and gradual business re-openings for the delinquency rate improvement.

The report said the lodging sector has seen the most distress with a 10.7 percent delinquency rate in the first quarter. This represents a 260-basis-point improvement from late 2020, when it reached 13.3 percent. The retail sector had the second-highest delinquency reading in early 2021. It saw a 210-basis-point improvement quarter-over-quarter to 4.8 percent.

“Both sectors have benefited from economic re-openings around the country,” Nelson said. “The TSA recently reported that the number of flight travelers reached its highest number since the pandemic began, and hotels around the country have begun to see gradual returns in profits.”

Trepp reported the office sector’s delinquency rate stayed below 1 percent but was the only property type to see delinquencies rise during the first quarter, reaching 0.7 percent.

CRE occupancy rates fell nearly across the board over the past six quarters, with the multifamily sector seeing the largest drop, Trepp reported. Multifamily occupancy reached 94.1 percent for bank CRE loans in fourth-quarter 2019, compared to 89.5 percent in early 2021. The office and retail sectors also saw 3 or more percent occupancy declines in the same time frame, while industrial sector rates have dipped just over 100 basis points.

Lodging occupancy has seen a “sharp rebound,” Nelson said. Hotel occupancy fell below 44 percent in second-half 2020, a far cry from the 72 percent rate seen in late 2019. But that rate jumped to 62.6 percent in the first quarter.

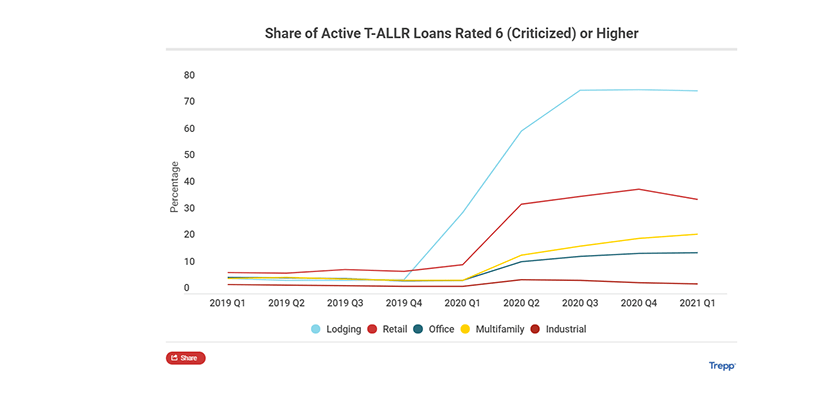

“This, however, does not mean that lodging loans are completely out of the water,” Nelson said. “A look at loan risk ratings shows that of the active loans across all property types, lodging has the highest percentage that is rank six or higher.” He said risk-rating ranks one through four signify “acceptably passing” loans, while a rating of five or above are much more likely to experience defaults or a loss. The number of lodging loans ranked six or higher jumped from 5.1 percent in late 2019 to 76.2 percent in first-quarter 2021.

“Ultimately the signs of recovery have begun to show, but the first quarter has only given us a small snippet of what will hopefully be a robust restart of the economy,” Nelson said.