MBA Mortgage Action Alliance ‘Call to Action’ on Secure Notarization Bill

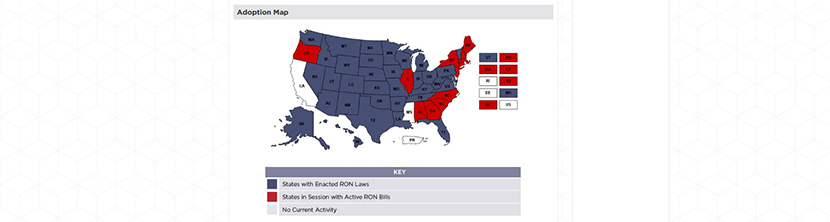

(Current MBA map of states with enacted Remote Online Notarization laws.)

The Mortgage Bankers Association’s grassroots advocacy arm, the Mortgage Action Alliance, issued a Call to Action Monday in support of bipartisan legislation that would allow notaries in all states to perform Remote Online Notarization transactions.

H.R. 3962, the SECURE Notarization Act of 2021, was introduced late last week by Reps. Madeline Dean, D-Pa., and Kelly Armstrong, R-N.D., with 31 co-sponsors. It is a companion bill to S. 1625, introduced by Sens. Mark Warner, D-Va., and Kevin Cramer, R-N.D.

As with the bill from the previous Congress, which ultimately failed to obtain passage in Congress, the SECURE Notarization Act of 2021 requires tamper-evident technology in electronic notarizations and provides fraud prevention using multifactor authentication for identity proofing and audiovisual recording of the notarial act.

Already, 35 states have passed laws to enable the use of RON. The federal legislation would complement existing state laws, while allowing states the flexibility and freedom to implement their own RON standards.

“COVID-19 made it clear that certain methods needed to be updated to keep up with our ever-changing world and economy,” Dean said. “One of the areas that this was most prevalent was our notarization process passing legislation like the SECURE Notarization Act allows us to do just that.”

MBA Senior Vice President of Legislative and Political Affairs Bill Killmer said the bill was a “key ask” during the recent MBA National Advocacy Conference.

“The SECURE Notarization Act is essential to support new homeowners and would help apply a measure of transactional freedom to the flow of essential real estate closing activities as Americans begin to fully emerge from the pandemic,” Killmer said.

Killmer added as a direct result of MBA’s direct outreach and advocacy, the bills’ minimum standards for RON are consistent with those provided in the MBA-ALTA model state RON bill and the Mortgage Industry Standards Maintenance Organization (MISMO) RON Standards.

Killmer said MBA will continue to work on garnering additional cosponsor support for the House and Senate bills in order to advance the legislation through the House and Senate. MBA will simultaneously advocate with state governments to promote laws that allow the use of RON in a manner that complies with MBA-developed principles.

MBA urged its members to contact their representatives in Congress to urge their support by co-sponsoring H.R. 3962.

For more information about the MBA Mortgage Action Alliance, visit https://www.mba.org/get-involved/take-action-with-maa.