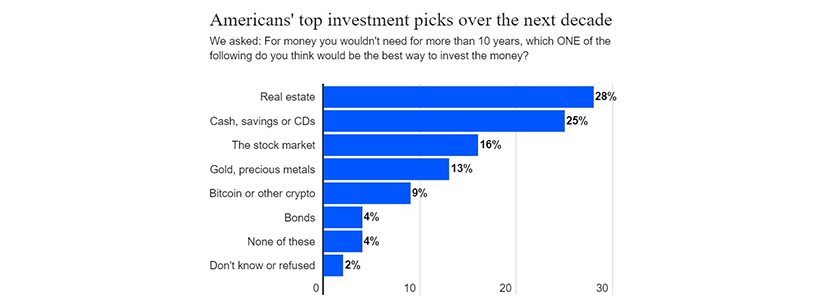

Bankrate: Real Estate, Cash Are Americans’ Top Preferred Investments Over Next 10 Years

Real estate and cash investments top the list of Americans’ preferred ways to invest over the next 10 years or more, according to Bankrate.com, New York.

Real estate reassumed the top spot, with 28% of Americans pointing to it as their preferred way to invest money not needed for a decade or longer, up from 26% last year. Amid record low interest rates and inflation on the rise, cash investments such as savings accounts or CDs, are a close second, jumping to the highest level since 2014, with 25% of Americans citing it, up from 18% last year. The survey can be found here.

Bankrate reported for the first time since 2017, the stock market ran a distant third behind real estate and cash, chosen by just 16%, despite topping the list in 2020 by 28% of Americans. Further, 13% cited gold and other precious metals (down from 14% last year), 9% picked cryptocurrency, such as Bitcoin, (up from 4% in 2019-20 and 2% in 2018), and 4% chose bonds (unchanged from last year) as their preferred long-term investment over a decade or more.

“Sentiment on the stock market has seesawed back and forth over the past 5 years,” said Bankrate.com chief financial analyst Greg McBride. “But building wealth over the long-term means remaining committed to holding on and consistently investing through the inevitable ups and downs.”

The stock market was more popular amongst the highest earning households (22% making more than $75,000 vs. 11% making less than $30,000) and college graduates (23% vs. 9% with no more than a high school diploma). Similar divides appeared in cash investments (30% earning less than $75,000 vs. 14% earning more than $75,000), and real estate (22% each: lowest earning households, those with no more than a high school diploma vs. 36% each: highest earning households; college graduates).

While more than one-third of Americans (35%) indicate some level of comfort with investing in cryptocurrencies such as Bitcoin, 61% say they are not comfortable. Nearly half of millennials (49%; ages 25-40) are comfortable investing in crypto, compared to 37% of Gen Xers (ages 41-56) and 22% of baby boomers (ages 57-75).

The survey also noted inflation does not appear to have much of an impact on how Americans would invest money over a decade or more, with 58% indicating that it will not change how they invest. Millennials (29%) had the highest likelihood of saying they would invest more aggressively due to higher inflation, compared to 19% of Gen Xers and 14% of baby boomers.

“The strong preference for cash is ironic given record low interest rates and renewed concerns about inflation, and could be particularly damaging the longer inflation exceeds returns on cash investments,” McBride said. “While the pandemic has underscored the need to have sufficient short-term savings, cash investments do not pay off over long time periods.”