Domino Effect: Single-Family Rent Growth Rate Spikes in May as Housing Economy Challenges Persist

CoreLogic, Irvine, Calif., said single-family rent growth reached 6.6% year-over-year in May, up from a 1.7% year-over-year increase in January 2020.

The CoreLogic Single-Family Rent Index analyzes single-family rent price changes nationally and across major metropolitan areas. It said the shift in consumer preferences toward lower-density communities and single-family shelter has caused a “ripple effect” in the rental market, with single-family rent growth reaching the highest level since at least January 2005.

Due to high purchase prices and ongoing limited availability of for-sale homes, would-be first-time buyers are opting to remain renters instead of entering the housing market, CoreLogic noted. However, similar inventory and affordability challenges are also emerging in the rental space. The Census Bureau reported that single-family rentals averaged 94.5% occupancy for first-quarter 2021, up from 93.7% one year earlier, which pushes rent prices up.

“Single-family rents rose by nearly four times the rate from a year earlier in May 2021,” said Molly Boesel, Principal Economist at CoreLogic. “Strong job and income growth as well as fierce competition for for-sale housing is fueling demand for single-family rentals.”

Boesel said she expects these market forces to remain for much of the year and keep rent increases high, “particularly in urban areas and tech hubs as more people return to working in person.”

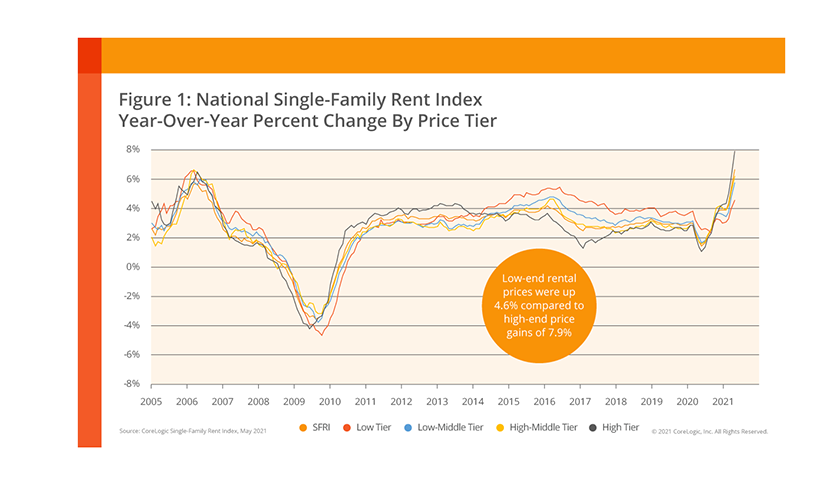

CoreLogic studied four tiers of rental prices. National single-family rent growth across the four tiers, and the year-over-year changes, were:

–Lower-priced (75% or less than the regional median): 4.6%, up from 2.7% in May 2020

–Lower-middle priced (75% to 100% of the regional median): 5.8%, up from 2.0% in May 2020

–Higher-middle priced (100% to 125% of the regional median): 6.2%, up from 1.7% in May 2020

–Higher-priced (125% or more than the regional median): 7.9%, up from 1.3% in May 2020

Among the 20 largest metro areas, Phoenix once again had the highest year-over-year increase in single-family rents in May at 14%. Tucson, Ariz., had the second-highest rent growth with 11.1%.

Some tourist destinations that were hit hard by the pandemic also show strong signs of recovery, with Las Vegas logging the third-highest year-over-year rent growth, 10.7%. And while Boston has experienced significant rent price decreases for 11 consecutive months (with an annual decline of 4.5% in May) the area’s rate of decline slowed compared to previous months.