Demand For Vacation Homes Falls for First Time in a Year

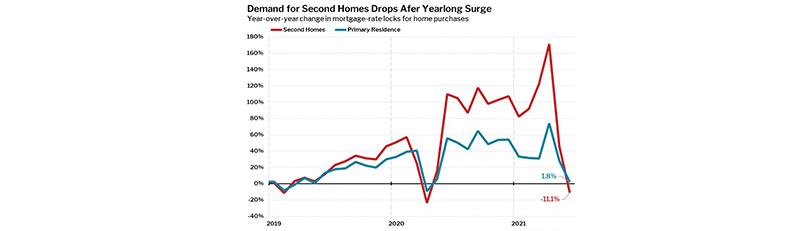

(Chart courtesy Redfin.)

Redfin, Seattle, said buyers who locked in mortgage rates to purchase a second home nationwide fell 11.1% year over year in June, a reversal from the yearlong surge in demand for vacation homes driven by the pandemic.

This marks the first decline since April 2020 and follows more than a year of double- and triple-digit increases in mortgage-rate locks for second homes, Redfin said.

“Demand for second homes is dropping back down to earth as many employees return to the workplace this summer,” said Taylor Marr, Redfin lead economist. “That return to the office, along with soaring prices and tighter lending standards for second homes, is shifting homebuyer demand in favor of primary residences. The allure of owning a vacation home outside the city still exists—as it did even before the pandemic—but the big second-home boom we’ve seen over the last year is abating.”

The report said demand for second homes started surging in June 2020 as pandemic-related lockdowns and remote work made vacation destinations ultra-desirable and affluent buyers took advantage of low mortgage rates. However, Redfin said the drop in year-over-year growth rate is somewhat exaggerated because mortgage-rate locks for second homes soared in June 2020. After accounting for the impact of the June 2020 surge, it’s clear that demand for vacation homes is starting to slow down but is still slightly above pre-pandemic levels. The price-growth gap between seasonal and non-seasonal towns has narrowed since the height of the pandemic

Home prices in seasonal towns, where second homes are often located, rose 28% year over year in June to $468,000. June marks the 12th month in a row of 10%-plus year-over-year price growth for homes in seasonal towns.

“With workplaces making their remote work policies permanent and employees feeling more confident making long-term decisions, many Americans are moving full time to scenic vacation towns rather than purchasing second homes,” said Redfin Chief Economist Daryl Fairweather. “That’s one reason why demand for second homes is waning while seasonal areas remain popular.”

Meanwhile, home prices in non-seasonal towns were up 26% to $421,000. The price-growth gap between seasonal and non-seasonal towns has narrowed since the height of the pandemic. The discrepancy peaked in September 2020, when prices in seasonal towns increased 22% year over year, versus 13% for non-seasonal towns.