Small-Cap CRE Bounces Back

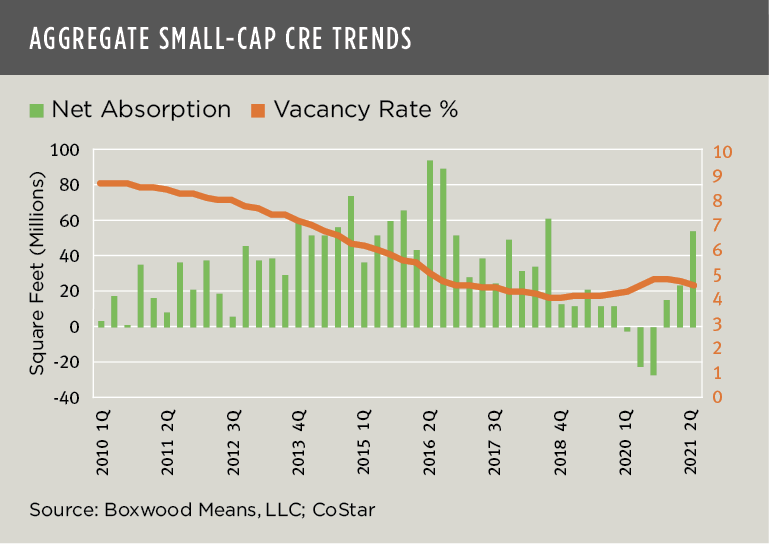

Boxwood Means LLC, Stamford, Conn., said small-cap commercial real estate is coming back into balance with larger properties after pandemic-induced shocks to the U.S. economy and the CRE markets.

Boxwood Means LLC Principal and Co-founder Randy Fuchs noted net absorption in smaller CRE properties “shifted into higher gear” during the second quarter. “Net absorption rose for the third quarter in a row across the industrial, retail and office sectors as small business employment continued to expand,” he said. “Aggregate demand was more than two times the first quarter’s volume, the best increase in twelve quarters.”

Fuchs said small-cap industrial demand is “red hot” again. Demand surged as manufacturing, transportation and warehousing produced 713,000 net new jobs since last June. As employment rallied, small-cap industrial space occupancy jumped more than 50 percent to nearly 25 million square feet. Industrial vacancies dropped 30 basis points to 3.3 percent, near the record low 3 percent set in 2018.

The office sector also mounted a “respectable comeback” during the second quarter, Fuchs said. “After five consecutive quarters of net occupancy losses–the longest string since at least 2006–small-cap office demand rebounded,” he said. The 8.5 million square feet of positive net absorption represented the best quarterly gain in three years.

“That said, office markets are still on shaky ground,” Fuchs said, noting the national small-cap office vacancy rate eased only 10 basis points to 7.1 percent, still the highest rate in five years.

Retail fundamentals beat expectations, Boxwood Means reported. Small-cap retail occupancies rose 20.1 million square feet, the best quarterly performance in nearly three years. The national vacancy rate dropped 20 basis points to 4.3 percent, returning to the level seen a year earlier. Total small-cap retail space availabilities narrowed by 30 basis points to 5.6 percent, matching the lowest level on record, as sublet deals increased.

“For a sector whose general demise has been widely exaggerated, [the retail sector’s] resilience was convincingly affirmed during the second quarter,” Fuchs said.