Fannie Mae: Homebuyer Satisfaction with Mortgage Process Remains High

Homebuyer satisfaction with the mortgage process remained high during the pandemic year, said Fannie Mae, despite most lenders facing the challenges of remote working and increased volume.

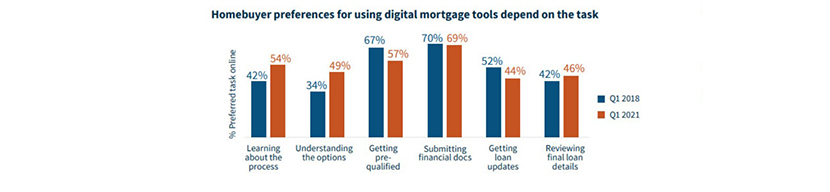

As part of the most recent Fannie Mae National Housing Survey special topic analysis, Jenney Shen and Tim McCallum, Fannie Mae Vice Presidents of Customer Management Solutions, found that consumers continue to prefer a mix of digital and in-person resources, depending on the task, and once again expressed satisfaction with the mortgage process, despite the challenges presented by the pandemic.

“We learned that, overall, consumers felt satisfied with their mortgage experience, despite lenders moving to remote working conditions and handling record-high origination volume,” the authors said. “Credit unions and traditional banks received slightly higher satisfaction rates than mortgage banks.”

Contrary to expectations, the analysis found consumers did not report a sizable increase in their use of online channels for their mortgage tasks, although there was a slight increase from previous years. “Among consumer segments, there were differences in online preferences, indicating that a ‘one size fits all’ digital process may not be the right approach to best meet the needs of all consumer groups,” the authors said.

Other key findings:

–Homebuyer satisfaction with the mortgage process remained high during the pandemic year, despite most lenders facing the challenges of remote working and increased volume. In Q1 2021, 88% of recent homebuyers expressed satisfaction with their mortgage process, compared to 90% in Q1 2020.

–These consumer satisfaction ratings are unlikely to come as a surprise to most lenders, as the results align with other findings from the Fannie Mae Economic and Strategic Research Group. As part of our Q1 2021 Mortgage Lender Sentiment Survey, 78% of lenders told us that the consumer mortgage experience had improved or remained the same during the pandemic.

–Of those who used digital channels, a majority of recent borrowers (57%) said the pandemic had no impact on their decision to use digital channels, but a reasonable proportion (38%) did indicate that the pandemic had some influence on their decision to use digital channels.

–From a potential homebuyer perspective, the shift to digital continues to be a gradual process, with certain segments showing different online servicing/in-person needs. Since buying a home is an infrequent and complicated expense, shifting to online-only channels appears to be an imperfect solution for many borrowers who have questions and want to make the right choices.

The report can be accessed here.