Most Americans Falling Behind on Retirement Planning

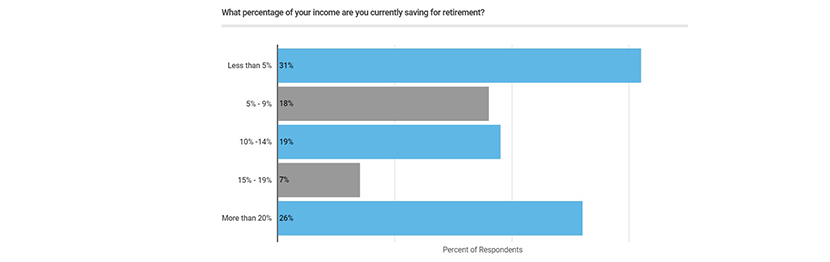

(Chart courtesy of Clever Real Estate.)

A report from Clever Real Estate, St. Louis, shows the majority of Americans are not saving enough money for their retirement—and retirees are living beyond their means.

The report (https://listwithclever.com/research/retirement-finances-2021/) said retirees have only about 39% of the recommended savings and, as a result, have accumulated more debt (nearly doubling it in the last year alone) and taken on part-time jobs to cover living expenses.

“Many retired Americans wish they saved differently while they were working and are now worried they’ll outlive their savings,” said Francesca Ortegren, Data Scientist with Clever Real Estate. “Most Americans work throughout adulthood with the hopes of retiring from the workforce someday. Ideally, the milestone is achieved when one is young enough to enjoy their work-free lives without worries about finances or debt.”

Key report findings, based on a survey of 1,500 Americans:

• Retirees average $177,787 in retirement savings, just 39% of the $465,000 that analysts recommend.

• Just 35% of retirees believe they prepared adequately for retirement.

• 59% of retirees say they retired earlier than planned, mostly due to health issues (65%) or job loss (22%).

• The average retiree has about $19,200 in non-mortgage debt and increased their debt by $9,779 in 2020 — a 104% increase from 2019.

• 60% of retirees say they struggle to pay for basic necessities, including medical bills (47%), groceries (43%), and credit card bills (37%).

• 1 in 4 retirees worry they’ll outlive their savings.

• Nearly 1 in 5 retirees has taken on a part-time job, including 9% who have taken on additional income because of the pandemic.

• Non-retirees are more confident they will live a comfortable retirement: 57% say they are saving enough for retirement. However, 19% have saved nothing for retirement.

“Unfortunately, half of U.S. households can’t maintain their pre-retirement standard of living throughout retirement,” Ortegren said. “Many Americans are forced to tighten budgets and give up luxuries during retirement, partly due to dismal savings and an upward trend in financial struggles among more than 80% of households with adults older than retirement age.”

The report noted the decline in household wealth is “particularly concerning” during a pandemic that has disproportionately impacted the health of older adults. “Infection can lead to unexpected costs related to acute or long-term healthcare, loss of the ability to live independently, and the death of a partner,” it said. “Many don’t have the means to cover a financial shock, and even fewer have a cushion to fall back on.”