Canada Retains Lead for Cross-Border U.S. CRE Investment

Canadian investors once again sank more money into the U.S. commercial property market than any other country last year, reported Real Capital Analytics, New York.

Canadian investment into U.S. CRE fell 10 percent in 2020 compared to the year before to $12.4 billion. But even after the drop, Canadian acquisition volume remains more than double any other country’s volume.

Meanwhile, investment from South Korea increased nearly 90 percent last year to reach $5.2 billion. German investors decreased their acquisitions significantly but remained in third place, while investors from Singapore and the U.K. spent more on U.S. commercial property in 2020 than in 2019 and ranked fourth and fifth, respectively.

RCA Analyst Michael Savino said total cross-border investment into U.S. commercial property declined 31 percent in 2020 from 2019, in line with the overall U.S. market decline.

Global sales of commercial real estate fell by nearly one-third year-over-year due to the COVID-19 pandemic, but the pace of declines in many leading markets, including the U.S., moderated in the fourth quarter, RCA said.

“For the fourth quarter, cross-border flows matched levels seen a year earlier, while investment by domestic U.S. players dropped,” Savino said. “Early in the pandemic there were fears that travel restrictions and lockdowns would stymie purchases by overseas investors.”

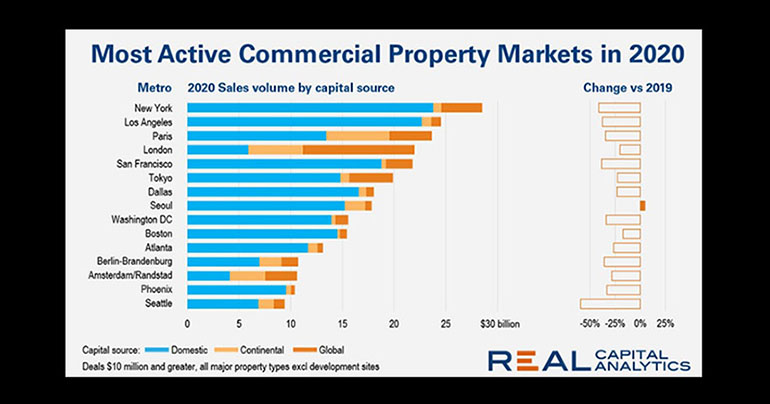

RCA said sales volume fell in 14 of the 15 largest global commercial real estate markets in 2020 as the COVID-19 pandemic hampered dealmaking. Metro New York remained the world’s largest market even though deal activity fell 41 percent versus 2019. Los Angeles ranked second, followed by Paris, London and San Francisco.

RCA noted the industrial sector captured more than 30 percent of all cross-border spending in the U.S. last year, “mirroring the broad investor leaning to this property type,” Savino said. Investors from South Korea in particular favored the sector, putting well over half of their U.S.-bound capital into the industrial market. Global investors also pursued the apartment sector in 2020, while the office sector lost ground.

“For the beleaguered hotel sector, 2020 was the worst year since the Global Financial Crisis,” RCA said, noting hotel property sales fell by 65 percent year-over-year, the steepest decline among the major property types.