4Q GDP Second Estimate Slightly More Optimistic

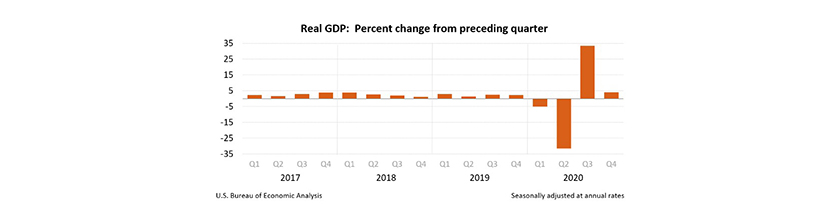

The Bureau of Economic Analysis yesterday revised upward ever-so-slightly its second (revised) estimate of fourth quarter gross domestic product.

The report said real GDP increased at an annual rate of 4.1 percent in the fourth quarter, up slightly from its first estimate of 4 percent. In the third quarter, real GDP increased by 33.4 percent. The GDP estimate released today is based on more complete source data than were available for the “advance” (first) estimate issued last month. With the second estimate, upward revisions to residential fixed investment, private inventory investment, and state and local government spending were partly offset by a downward revision to personal consumption expenditures.

BEA said the increase in real GDP reflected increases in exports, nonresidential fixed investment, PCE, residential fixed investment and private inventory investment that were partly offset by decreases in state and local government spending and federal government spending. Imports, a subtraction in the calculation of GDP, increased.

BEA noted the increase in fourth-quarter GDP reflected both the continued economic recovery from the sharp declines earlier in the year and the ongoing impact of the COVID-19 pandemic, including new restrictions and closures that took effect in some areas of the United States. “The full economic effects of the COVID-19 pandemic cannot be quantified in the GDP estimate for the fourth quarter of 2020 because the impacts are generally embedded in source data and cannot be separately identified,” BEA said.

The report said the increase in exports primarily reflected an increase in goods (led by industrial supplies and materials). The increase in nonresidential fixed investment reflected increases in all components, led by equipment (mainly transportation equipment). The increase in PCE was more than accounted for by spending on services (led by health care); spending on goods decreased (led by food and beverages). The increase in residential fixed investment primarily reflected investment in new single-family housing. The increase in private inventory investment was more than accounted for by an increase in manufacturing that was partly offset by a decrease in retail trade.