CMBS Delinquency, Special Servicing Rates Fall

The commercial mortgage-backed securities delinquency and special servicing rates both fell in February, analysts reported.

Fitch Ratings, New York, said the CMBS delinquency rate fell 22 basis points to 2.48 percent in February, driven by stronger resolution volume and fewer new delinquencies.

The Fitch North America CMBS Market Trends report said February resolutions totaled $1.6 billion, nearly double January’s volume of $786 million. Most resolutions came from the retail (51 percent; $796 million), hotel (19 percent; $297 million) and office (19 percent; $291 million) sectors.

New delinquencies totaled $275 million in February–the lowest level since the pandemic started and a significantly drop from January $1 billion figure, Fitch reported. But the 30-day delinquency volume rose slightly to $832 million from $711 million in January.

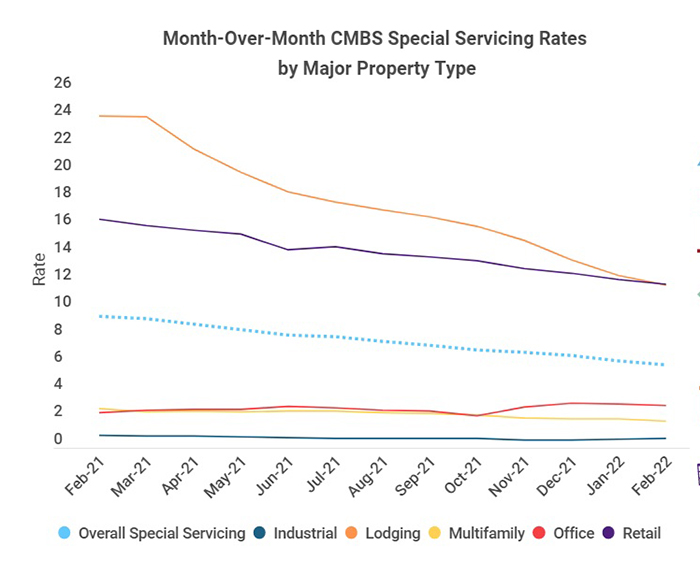

Maximillian Nelson, Research Analyst with Trepp LLC, New York, said the CMBS special servicing rate also dipped in February. The rate fell 25 basis points in February to 6.08 percent, down from 9.60 percent a year ago, he said.

“For the second month in a row, the largest cures in February were concentrated in the lodging and retail sectors,” Nelson noted.

Fitch said the hotel sector had the highest CMBS delinquency rate with 8.39 percent, down from 8.80 percent in January. The retail sector ranked second with 6.85 percent, down from 7.56 percent. Multifamily and industrial real estate saw the lowest delinquency rates at 0.36 percent and 0.15 percent, respectively.

In its monthly CMBS Highlights for February, DBRS Morningstar, Toronto, said CMBS liquidation activity remains “subdued’ by historical standards as the volume of liquidated loans posted its sixth consecutive month below $400 million and the weighted-average loss severity sits below its historical average.

The year-to-date maturity payoff rate registered 57.4 percent, but DBRS said it expects that figure to rebound and rise to roughly 70 percent for 2022.