Consumer Confidence Finishes 2021 on Improving Note

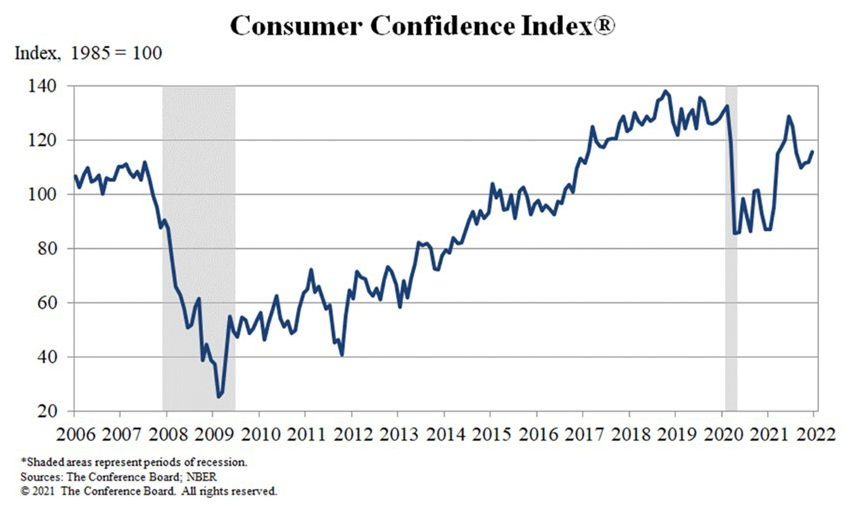

The Conference Board, New York, said its monthly Consumer Confidence Index increased for the second straight month in December, after an upward revision in November.

The Index now stands at 115.8, up from an upwardly revised 111.9 (from 109.5) in November. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—was relatively flat at 144.1, down from 144.4 last month. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—rose to 96.9 from 90.2.

“Consumer confidence improved further in December, following a very modest gain in November,” said Lynn Franco, Senior Director of Economic Indicators with The Conference Board. “The Present Situation Index dipped slightly but remains very high, suggesting the economy has maintained its momentum in the final month of 2021. Expectations about short-term growth prospects improved, setting the stage for continued growth in early 2022. The proportion of consumers planning to purchase homes, automobiles, major appliances, and vacations over the next six months all increased.”

Franco also noted concerns about inflation declined after hitting a 13-year high last month as did concerns about COVID-19, despite reports of continued price increases and the emergence of the Omicron variant. “Looking ahead to 2022, both confidence and consumer spending will continue to face headwinds from rising prices and an expected winter surge of the pandemic,” she said.

Other findings:

–19.9% of consumers said business conditions were “good,” up from 17.9%.

–6.8% of consumers said business conditions were “bad,” down from 27.3%.

–Consumers’ assessment of the labor market was moderately less favorable; 55.1% of consumers said jobs were “plentiful,” down from 55.5%; still a historically strong reading. 12.5% of consumers said jobs are “hard to get,” up from 10.8%.

–Consumers’ optimism about the short-term business conditions outlook increased in December, with 26.7% of consumers expect business conditions will improve, up from 25.6%. 17.9% expect business conditions to worsen, down from 19.6%.

–Consumers were also more optimistic about the short-term labor market outlook; 25.1% of consumers expect more jobs to be available in the months ahead, up from 22.8%. 14.8% anticipate fewer jobs, down from 19.0%.

–Consumers were slightly less positive about their short-term financial prospects; 18.0% of consumers expect their incomes to increase, down from 18.9%, while 11.5% expect their incomes will decrease, down slightly from 11.7%.